How To Buy Bitcoin (BTC) in Australia: A Beginners Guide

Published 11 Sep, 2021 Updated 18 Dec, 2022

Table of Contents

In terms of market capitalization, Bitcoin (BTC) is the largest cryptocurrency in the world. Created in 2009, Bitcoin’s value has dramatically increased, and is now a trillion-dollar market. Alongside its popularity, the trading of Bitcoin has grown multi-fold and it can now be bought and sold with almost every crypto exchange in Australia.

This guide describes the step-by-step process of how to buy Bitcoin from a top Australian-based crypto exchange.

What Is Bitcoin?

Bitcoin (BTC) is a digital currency that can be bought, traded, or sold on a decentralized network system. Since it operates over a decentralized ledger called the blockchain, it is free of any regulatory governance or oversight from financial institutions and governments. Instead, it relies on peer-to-peer software and cryptography.

During its public launch in 2009, the value of a single Bitcoin was $150. Since then, its value has risen dramatically and one Bitcoin in 2021 is worth around AUD$72,000. The number of Bitcoins that can be mined is capped at 21 million, and many expect its price to continue to rise due to the finite supply and blockchain technology becoming more mainstream.

The Origins Of Bitcoin

Bitcoin was created by a person, or persons, known as Satoshi Nakamoto. In August 2008, Nakamoto authored a whitepaper titled Bitcoin: A Peer-to-Peer Electronic Cash System. In January 2009, the software’s open-source code was implemented and Bitcoin was released. The Bitcoin network was created when Nakamoto mined the first block of the blockchain, known as the “genesis block”.

Best Places To Buy Bitcoin In Australia for 2022

To purchase cryptocurrencies in Australia, you will need to choose a reputable and secure crypto exchange that allows you to use Australian Dollars (AUD), offers low trading fees, and a user-friendly interface. A local Aussie platform also provides significant benefits such as more responsive customer support and a suite of other crypto features that are targeted to the Aussie market.

The comparison table below shows the best four platforms in Australia where you can safely buy BTC. These platforms have been selected based on a comprehensive review of each of their crypto features, fees, ease of use, customer support, and other aspects.

| Exchange | Assets | Trading Fees | Our Ratings | Learn More | Promotion |

|---|---|---|---|---|---|

|

|

312 | 0.6% | 4.8/5 | Visit Swyftx Swyftx Review | $20 Free Bitcoin for creating a new account |

|

|

300+ | 0.5% | 4.7/5 | Visit Digital Surge Digital Surge Review | None available at this time |

|

|

330+ | 1% | 4.6/5 | Visit CoinSpot CoinSpot Review | None available at this time |

|

|

30 | 0.5% | 4.5/5 | Visit Independent Reserve Independent Reserve Review | None available at this time |

|

|

600+ | 0.1% (maker) and 0.1% (taker) | 3.7/5 | Visit Binance Australia Binance Australia Review | None available at this time |

To aid with the explanatory process, we have used Swyftx as the example cryptocurrency exchange. Based on our research, Swyftx is the best overall crypto exchange in Australia to buy, trade, and sell Bitcoin.

Any affiliate links with our partners may result in MoreCrypto earning a small commission or compensation at no extra cost to you whatsoever.

5 Steps To Buy Bitcoin In Australia

The five steps to buying BTC in Australia are as follows:

- Open an account with a reputable and secure exchange such as Swyftx.

- Submit your proof of ID to verify your identity and activate 2 Factor Authentication (2FA).

- Deposit Australian Dollars (AUD) funds into your account using one of the supported methods (bank transfer, POLi, PayID, or credit card).

- Enter the amount of Bitcoin to buy or the amount of AUD to spend.

- Review the details and confirm the purchase.

Guide To Buying Bitcoin In Australia

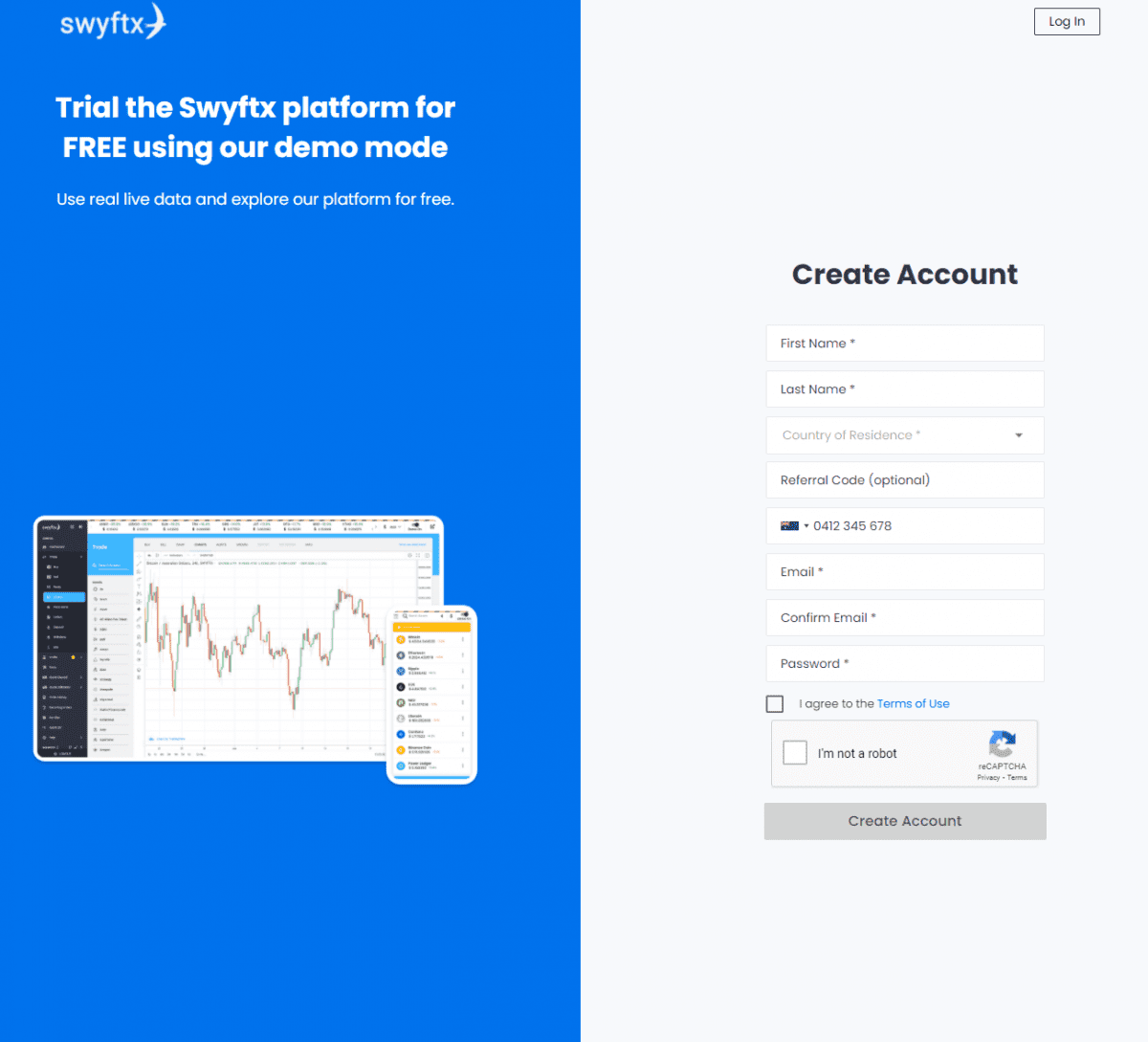

Step 1 – Opening An Account With A Crypto Exchange

Using our link to collect $10 BTC, go to the Swyftx website and click on the “Sign Up” button. This will redirect you to the registration page where an email address, password, and phone number will be required to be provided.

Once the details are entered, accept the terms and conditions and click on “Create Account”.

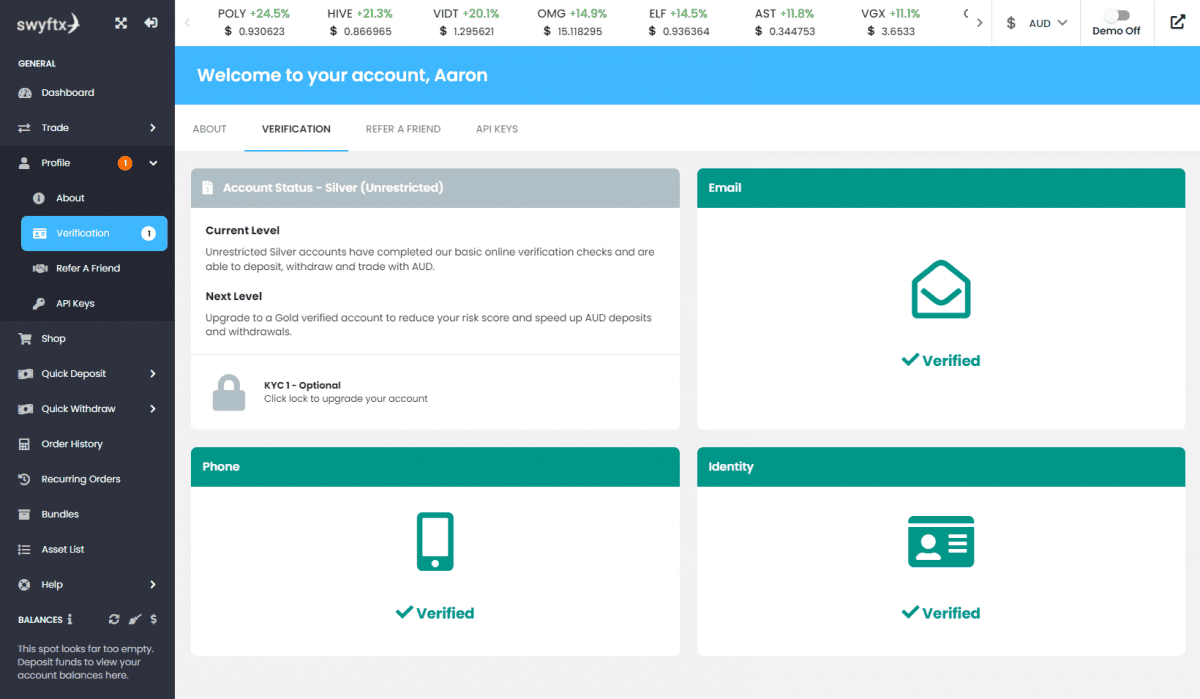

Step 2 – Verify Your Identity

Using the new login details, login into your Swyftx account to commence the ID verification process. Since Swyftx is an Australian-based crypto exchange, it is legally required under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 to obtain customer details and verify identities. This process must be completed before any AUD can be deposited into the account wallet.

The following will be required to complete ID verification:

- Email – login into the nominated email account and click on the email verification email sent by Swyftx.

- Phone number – Swyftx will send an SMS message to the nominated phone number.

- Identity – Swyftx will require copies of one Australian government-issued document such as a passport or driver’s license.

The ID verification process with Swyftx takes less than 5 minutes to complete.

After the ID verification process is complete, we strongly recommend setting up 2 Factor Authentication (2FA). 2FA provides a basic level of security for the account where two methods of verification are needed to verify the account and also when funds are withdrawn. The 2FA setup page can be found under the “About” tab on the user account dashboard.

We suggest downloading Google Authenticator on a mobile device. The process will involve the use of the authenticator to scan a QR code or input a provided code to enable authentication of the device.

Tip: If the six-digit code provided by Google Authenticator does not work, then go into the settings and sync the time correction for codes. This should rectify the issue.

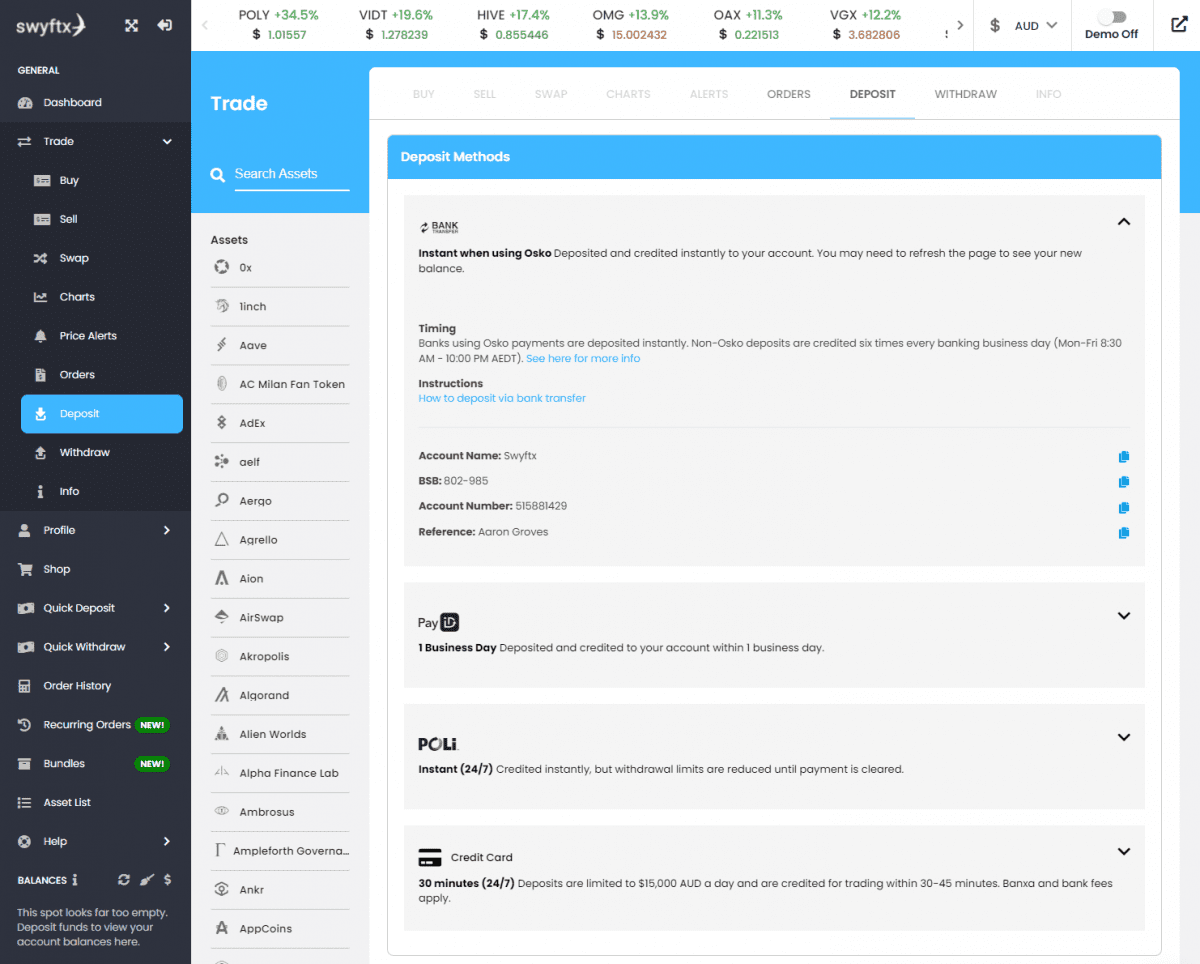

Step 3 – Deposit AUD Into Your Account

Before Bitcoin can be purchased, Australian Dollars (AUD) will need to be deposited into the account wallet. When it comes to depositing funds, it is wise to be mindful of the fees and the time taken to complete the transfer of funds.

Most Australian exchanges will offer several ways to deposit AUD, with the most common being direct bank transfer, POLi, and PayID. Swyftx is one of the few exchanges which offer deposits via credit card. Most of these methods will instantly deposit AUD into the account except bank transfers (unless via OSKO which is instant) and deposits made from credit cards. Swyftx does not charge any fees to deposit (or withdraw) funds into your wallet.

Note, that Swyftx will send an automated email notifying you of the successful deposit of AUD funds into the wallet.

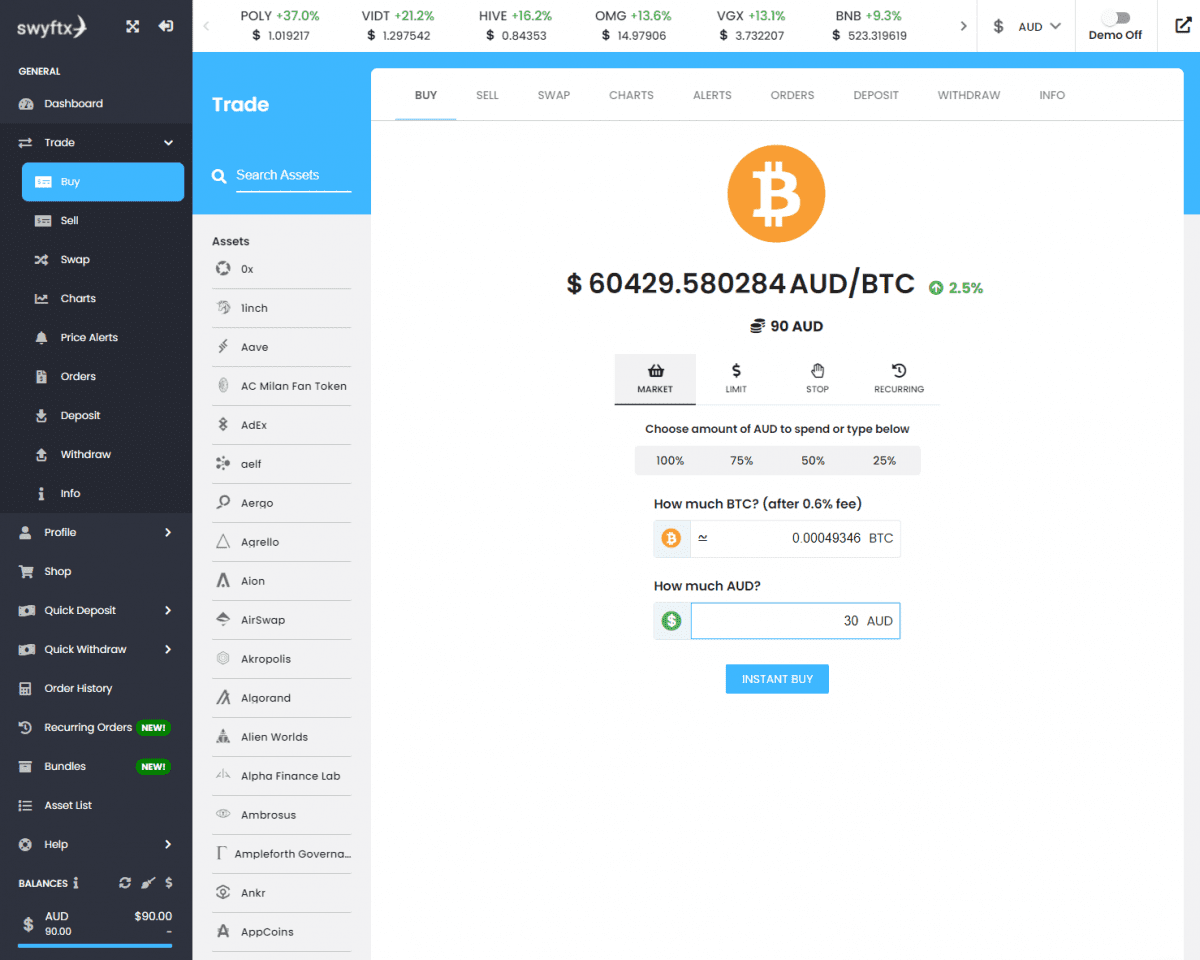

Step 4 – Enter In the Purchase

The buying window can be found under “Trade”. Next, click on “Buy” to view the screen below. The page will present the following:

- Amount of AUD in the wallet and available to spend.

- The current market price of Bitcoin.

- Several order types (market, limit, stop, and recurring)

The default order type is “Market” which allows beginner investors to easily and quickly purchase Bitcoin in a single transaction.

The other order types are for intermediate to advanced investors and a discussion of each type is detailed in our Swyftx review. You will have the option of either entering in the amount of Bitcoin you want to purchase, or the amount of AUD you want to spend to buy Bitcoin.

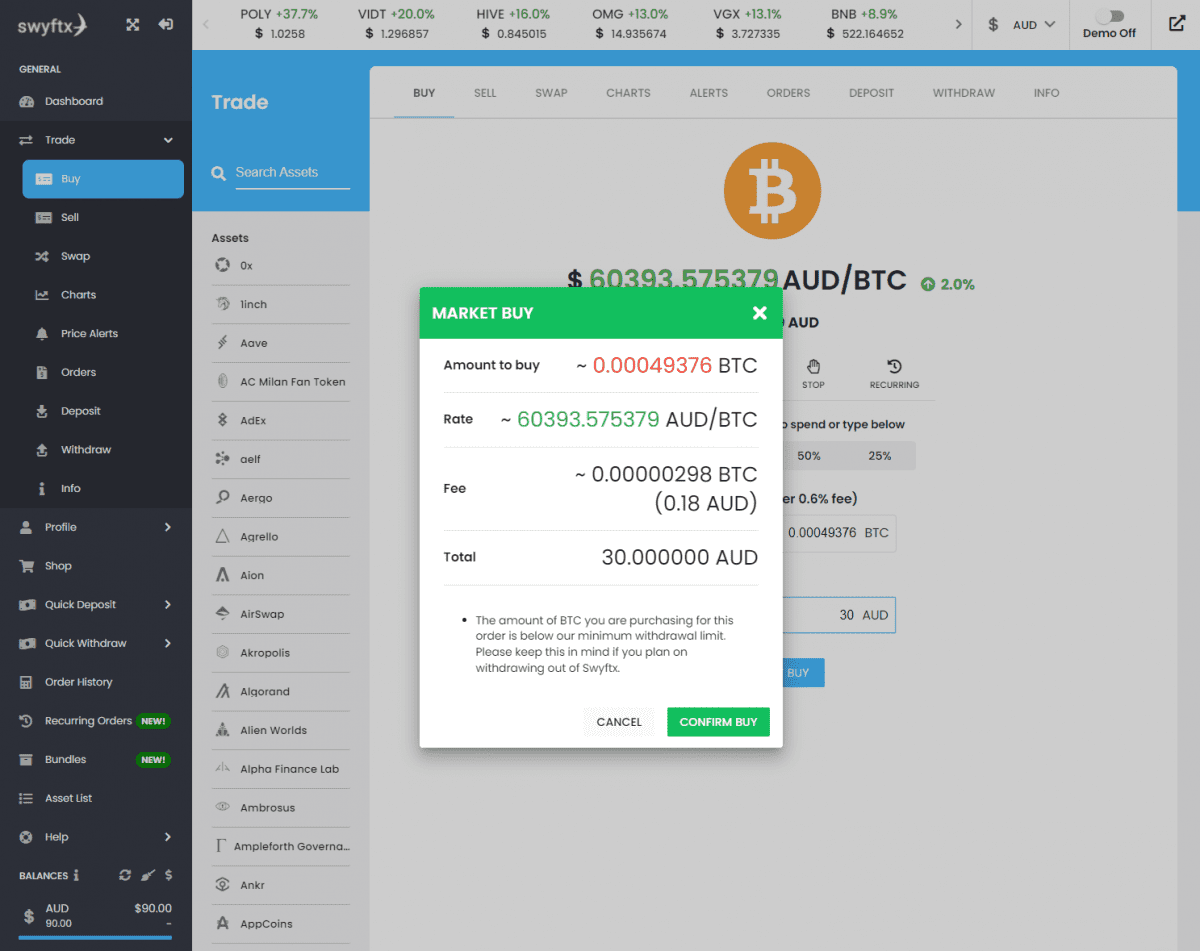

Step 5 – Review & Confirm The Purchase

After an amount of AUD is entered in, the amount of Bitcoin that will be purchased will be presented and will be inclusive of the trading fee (0.6%). Click on “Instant Buy” to review the transaction details and “Confirm Buy” to complete the purchase. Note, that once the purchase is confirmed, it cannot be reversed and AUD funds are recovered.

Buying Bitcoin In Australia: Frequently Asked Questions

Why Was Bitcoin Created?

Bitcoin was created as a digital alternative to traditional fiat currencies such as the United States Dollar (USD) and Australian Dollar (AUD). The intention was for it to be traded over the internet as a payment system that would be free of the control of financial institutions and governments.

How The Bitcoin Blockchain Works

The public ledger on which Bitcoin works records all transactions with copies held on computer servers around the world. Each computer server is known as a node. When Bitcoin is bought, traded, or sold, the details of the transaction are made known to every node. Therefore, this means that every transaction is transparent to everyone. Transactions are collected by miners who construct a digital block, with each block added to the blockchain.

Is Bitcoin Safe?

The cryptography that underpins the Bitcoin blockchain is based on the Secure Hash Algorithm (SHA-256) algorithm designed by the United States National Security Agency (NSA). In theory, a hacker would need to control at least 51% of the entire BTC network to create the consensus that they owned the associated Bitcoin. Transfers of the ‘owned’ Bitcoin could then be made to several wallets. Given the growing vastness of the network, a breach is highly impractical and unlikely.

There have been several high-profile cases of security breaches and losses or theft of staggering amounts of Bitcoin and other digital assets. The most infamous case is the Mt Gox case where approximately $350 million worth of Bitcoin was lost. Cases such as this have revolved around the theft or loss of digital assets held in storage by cryptocurrency exchanges and not the blockchain itself.

What Is Bitcoin Mining?

Bitcoin mining is the process where a new Bitcoin is created on the blockchain network. Transactions involving the purchase, trading, or selling of Bitcoin are eventually collected by miners and placed into new blocks. This is achieved by completing a cryptographic calculation The first miner to solve the calculation on t4he next block broadcasts it to the network, and if correct is added to the blockchain. The miner is then rewarded with a small amount of BTC.

Is Buying Bitcoin Legal in Australia?

The purchasing, trading, and selling of BTC and other digital assets is legal in Australia and is recognized as property by the Australian Tax Office (ATO). Since 2017, laws and regulations have been progressively introduced to control the crypto market. The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 mandates that all Australian-based crypto exchanges are registered with AUSTRAC and adhere to specific security requirements.

What Is The Best Platform to Buy Bitcoin In Australia?

In our opinion, the best cryptocurrency to buy Bitcoin is Swyftx. The Australian-based exchange is one of a few exchanges which utilize multiple order books to provide higher liquidity on trading pairs. The higher trading volume and market depth allow Swyftx to offer lower spreads. The platform is feature-rich and carefully designed with beginner and experienced investors in mind. A close second is Digital Surge.

What Is The Smallest Amount Of Bitcoin That Can Be Bought?

Investors residing in Australia are able to buy fractional amounts of Bitcoin. The minimum amount of Bitcoin that can be bought is governed by the cryptocurrency exchange and usually start upwards of AUD$2. The smallest unit of Bitcoin, the Satoshi, is a hundred millionth of one Bitcoin. The trading fee would exceed the purchase price and therefore making it impractical. Minimum Bitcoin purchase amounts are in place to account for mining and transaction fees.

What Is Bitcoin Dominance?

According to Forbes, Bitcoin is the dominant cryptocurrency amongst approximately 5,000 other coins and digital assets. Bitcoin dominance is the measure of the percentage of Bitcoin within the total cryptocurrency market cap. If there is an increase in Bitcoin dominance, alternate cryptocurrencies lose value against BTC and vice versa. At the time of writing, the total cryptocurrency market cap is estimated to be $1.94 Trillion. BTC has a market of approximately $875 Billion, therefore BTC dominance is around 45%.

How To Spend Bitcoin In Australia

The number of ways Bitcoin can be used or spent in Australia is increasing. Traders and investors can use Bitcoin to purchase goods and services using the following methods (but not limited to):

- Direct transferring of crypto from a wallet to the recipient’s address.

- Using a cryptocurrency debit card to send Bitcoin to a merchant. The process is akin to using a standard debit card where held assets can be accessed or loaded onto the card. Some exchanges offer these services, whilst others do not.

- Pay Australian bills directly using the Bitcoin BPAY biller code. Cointree and Digital Surge offer this service.

- Use stored Bitcoin to withdraw AUD from a Bitcoin ATM.

- Use Bitcoin to purchase goods from merchants such as Mooning Market. Moon Market works similar to Amazon and eBay.

Storing Bitcoin In Australia

Storing Bitcoin in Australia comes down to two options. Firstly, Bitcoin can be kept in the exchanges storage system, which can be cold storage (wallet), or a combination of hot and cold storage. Secondly, cold-storage wallets may be used by individuals to hold Bitcoin offline and usually in a physical state.

- Hot storage refers to a wallet that is connected to the internet and can be accessed at any time. Examples include online cloud wallets, mobile wallets, software wallets, and exchanges. Hot wallets are great for keeping an amount of BTC available for frequent buying, trading, and selling.

- Cold storage refers to a physical means of keeping crypto in a storage device and is only accessible by the wallet owner. Examples include hardware wallets such as CoolWallet Pro and the Ledger Nano X. Cold wallets are not connected to the internet.

Is It Legal To Buy Bitcoin In Australia?

The purchasing, trading, and selling of Bitcoin and other digital assets is legal in Australia and is recognized as property by the Australian Tax Office (ATO). Since 2017, laws and regulations have been progressively introduced to control the crypto market. The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 mandates that all Australian-based crypto exchanges are registered with AUSTRAC and adhere to specific security requirements.

Is Bitcoin Taxed In Australia?

If capital or financial gains are met with the buying, trading, or selling of Bitcoin, then it will be subject to Capital Gains Tax (CGT) under the Australian Tax Office (ATO) regulations. This typically applies to individual investors. On the other hand, traders who earn Bitcoin as payment resulting from commercial business will likely incur Income Tax.

For more information, read our guide on Bitcoin tax in Australia and consult a financial advisor.

Can I Use Bitcoin To Pay For Australian Bills?

Several Australian-based crypto exchanges such as Digital Surge and Cointree offer their customers to pay Australian bills using Bitcoin. Bitcoin is the most commonly supported digital asset that can be used as long as there is a BPAY biller code for Bitcoin.

Can I Buy Bitcoin Using A Credit Card?

Bitcoin can be purchased using a credit card however it depends on what exchange you are using as not all with providing this service. An exchange that accepts credit cards as a method to make AUD deposits will be essential. The fees are typically higher however the method provides a level of convenience. Reputable and trustworthy exchanges should be used to buy Bitcoin with a credit card such as Binance or Coinbase.

Can I Buy Bitcoin At An ATM?

A Bitcoin ATM is an internet-based connection kiosk where consumers can deposit cash in exchange for BTC or vice versa. They are usually associated with a particular cryptocurrency exchange where Bitcoin is sent to the customer’s wallet using a QR code. Bitcoin ATMs typically charge high fees, where the service fee is around 7-20% of the transaction amount.

Can I Use My SMSF To Invest In Bitcoin?

Yes, you can use your Self-Managed Super Fund (SMSF) to buy Bitcoin (BTC) from a secure and reputable Aussie exchange as part of a long-term store of value. Key legal and regulatory compliance requirements include the creation of a separate wallet that is independent of any personal digital assets, reporting capital gains events for taxation purposes, and achieving the sole purpose test.

For more information on the advantages and limitations, you can read our Australian SMSF cryptocurrency guide.

Did You Find What You Were Looking For?

Swyftx vs Crypto.com 2023: Which Is Better For Aussies?

Updated 02 Feb, 2023

There are quite a lot of differences in the crypto service offerings of Swyftx and Crypto.com. Which platform best suits your individual crypto needs?

Best Places To Earn Crypto Interest In Australia

Updated 02 Feb, 2023

There aren't too many options for Aussie to earn interest on their crypto, however, there is one local exchange that provides great rates on popular assets.

Digital Surge Referral Code – Claim Your Free $10 BTC

Updated 02 Feb, 2023

Our Digital Surge referral link will net you $10 free of Bitcoin upon creating a new account. Click here now to avoid missing out.