BTC Markets Review 2023: Is It Worthwhile Exchange?

Published 08 Oct, 2021 Updated 02 Feb, 2023

Table of Contents

- 1 Our Takeaways

- 2 What Is BTC Markets?

- 3 BTC Markets Pros & Cons

- 4 Top BTC Markets Features You Should Know

- 5 Is BTC Markets Regulated?

- 6 Security Measures

- 7 Are BTC Markets Fees Competitive?

- 8 Accepted Countries

- 9 Getting Started

- 10 The User Experience

- 11 Customer Support & Reviews

- 12 Mobile App

- 13 BTC Markets Alternatives

- 14 Frequently Asked Questions

- 15 Our Verdict

Australian crypto investors and traders are spoilt for choice in platforms that provide direct AUD to crypto trading. There are several considerations that should be made before committing, including their fee structure, reputability, security infrastructure and measures, and how responsive the customer service is.

BTC Markets is one of the few Australian-based crypto exchanges that have a long history of being a safe and trustworthy exchange.

Promotion: None available at this time

Trading Fees: 0.85%

Available Cryptos: 21

We work with partners that may result in MoreCrypto earning a small commission. Read our affiliate disclaimer for further information.

Our Takeaways

| Name | BTC Markets (BTC Markets Pty Ltd) |

| Core Services | Buy crypto with fiat, sell crypto to fiat, SMSF |

| Available Cryptocurrencies | 21 including BTC, XRP, ETH, and more. |

| Fiat Currencies | AUD |

| Deposit Options | OSKO (PayID), BPAY |

| Deposit Fees | None |

| Trading Fees | 0.85% |

| Withdrawal Fees | None |

| Mobile App | Not currently available |

What Is BTC Markets?

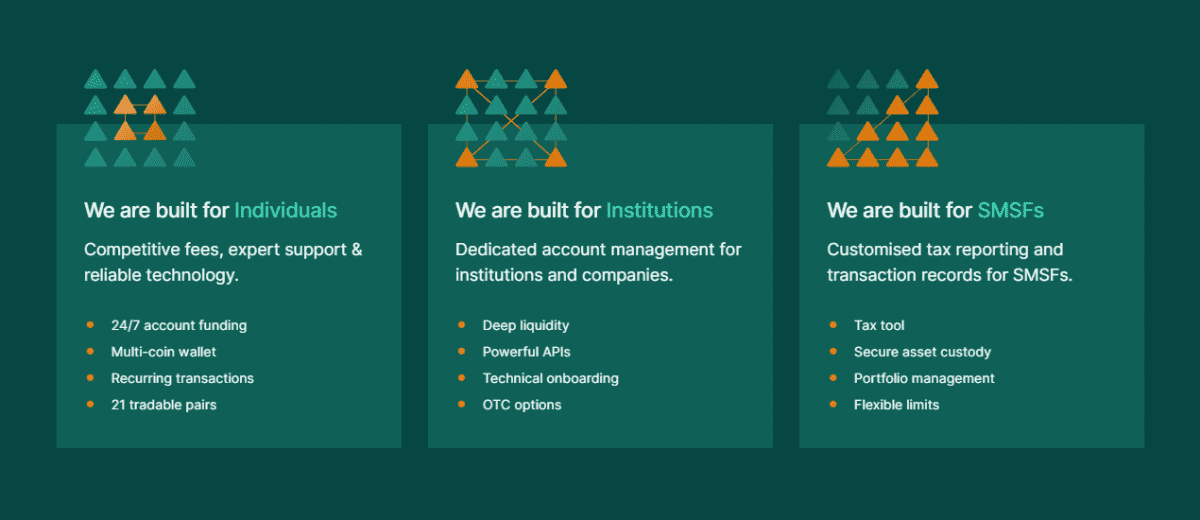

BTC Markets is a crypto exchange based in Melbourne, Australia. Since its inception in 2013, the exchange is one of Australia’s longest-running exchanges and has built a reputation for being a safe and trustworthy platform for buying, trading, and selling crypto using AUD. The platform has reached over 325,000 Australians and has successfully transacted over $17.1 billion.

With a high-performance trading interface, deep liquidity, and a variety of advanced autotypes and charting tools, their trading interface is world-class. Their fees for large volume trades are some of the best around and high net worth traders will be drawn to this exchange. BTC Markets are the Australian partner for the Ripple On-Demand Liquidity (ODL) program.

BTC Markets Pros & Cons

Pros

- Well established Australian crypto exchange

- Solid user interface

- Low trading fees for high-net investors

- Advanced order types including stop-limit, DCA, take profit and TIF

- Best-in-class charting and technical analysis tools

- OTC service

- Support for SMSF investors

Cons

- High fees for casual investors

- Limited supported crypto

- No iOS or Android mobile app

- Limited features and educational content

- Not as beginner friendly as other platforms

- Staking only available for ALGO

Top BTC Markets Features You Should Know

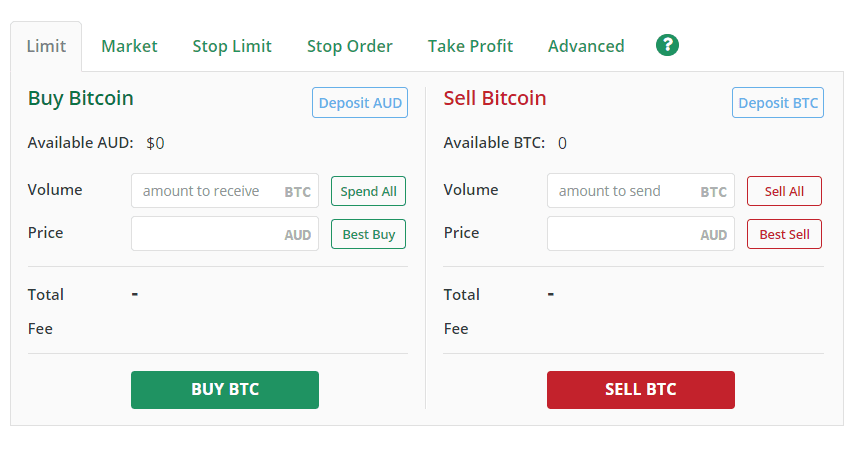

High-Performance Trading Interface

One of the main features offered by BTC Markets is their world-class trading experience through the renowned charting interface TradingView. TradingView is the benchmark of charting packages in the crypto world and offers a wide range of features that will satisfy traders of all levels. Real-time market data and charting to buy popular altcoins are also supported.

The buy/sell panels are at the bottom of the trading interface. The layout is typical of other ‘quick buy’ resemble where the following advanced order types can be found.

| ORDER TYPE | DESCRIPTION |

|---|---|

| Limit Order | The buy / sell price is set by the user. |

| Market Order | The asset will be bought / sold at the best available price. |

| Stop Limit | Automatically executes at the market price until it is fully matched or the market price exceeds the limit order. |

| Stop Order | Automatically places a market order once the stop price is met and completes the transaction once fully matched. |

| Take Profit | Can only be set above the market price and executes when the market price is matched or there are no other orders to be matched against. |

The availability of advanced charting and order types will benefit experienced traders and investors alike. Beginners may become overwhelmed by the advanced order types and are best to conduct their research before committing.

Dollar-Cost-Averaging Tools

BTC Markets offers Dollar-Cost-Averaging (DCA), otherwise known as recurring buys. DCA allows you to buy increments of a digital asset over a period of time to reduce the impact of volatility and short-term fluctuations on the overall purchase. Purchases are usually undertaken at smaller amounts regardless of the market price. This feature is not offered by all platforms in Australia and adds to the overall trading appeal of the platform.

Over-The-Counter Service

Over-The-Counter (OTC) trading is available for you to execute high-volume trades with minimal price slippage. BTC Markets offers personalized assistance for orders worth AUD$100,000 or more, which should provide you with added comfort and peace of mind dealing with large sums of money. You can access BTC Market’s global liquidity providers where tighter spreads and reduced slippage can be obtained.

In conjunction with the tiered trading fee structure, high-volume traders will also benefit from the low fees associated with amounts greater than AUD$100,000.

SMSF Investment In Digital Assets

One of BTC Markets major selling points is that it supports SMSF investment in Bitcoin (BTC), Ethereum (ETC), Ripple (XRP), and other listed digital assets. This is ideal for Australian investors who want to allocate a portion of their superannuation fund to cryptocurrency. SMSF features include:

- Tax reporting for annual audit preparation.

- Accessibility to BTC Markets global network through our liquidity providers.

- VIP, personalized service for large trades.

To sign up for SMSF investing, customers need to provide a letter of authority from the nominated super fund.

Want To Know More? Cryptocurrency SMSF Accounts In Australia

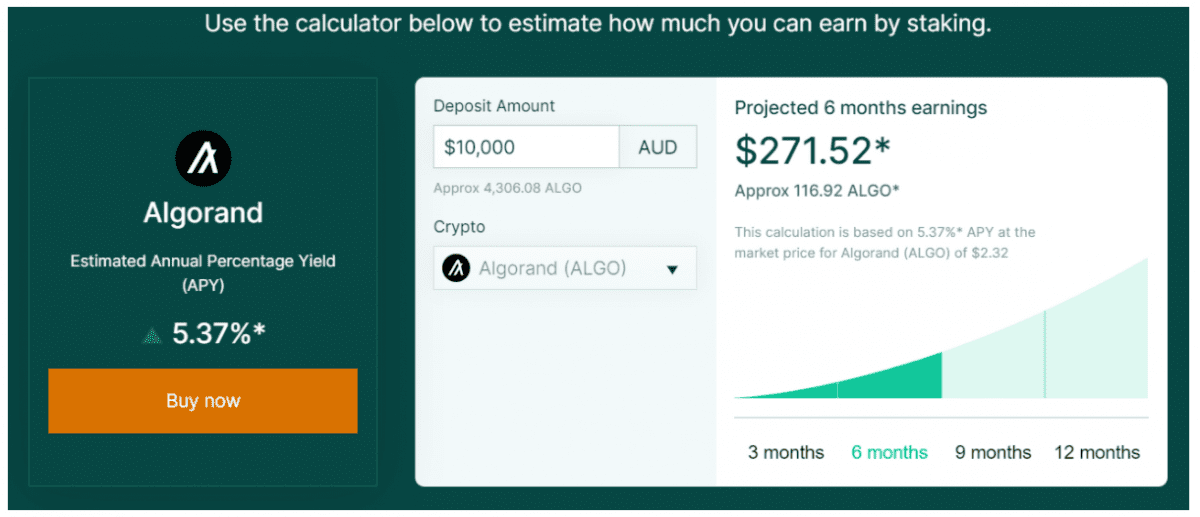

Algorand Staking

Algorand (ALGO) staking is available however is limited to this altcoin only and will not suit investors who are seeking to stake a range of coins. The minimum holding is 1 ALGO. All rewards earned during a period are paid to the user’s nominated bank account on the first day of each month.

Is BTC Markets Regulated?

The trading company, BTC Markets Pty Ltd (ACN 164 093 887, ABN 45 164 093 887) is registered with AUSTRAC to operate as a digital currency exchange. BTC Markets was also the first Australian exchange to achieve Blockchain Australia’s Gold Certification.

Security Measures

In late 2020, Business Insider reported that the usernames and email addresses of 270,000 Australian accounts were accidentally exposed as part of an email marketing campaign. Since email addresses are one-half of the login process, it was thought that the release of customer emails would lead to phishing attempts.

Security measures BTC Markets implement include encrypted cold storage for over 98% of the trader’s crypto funds, two-factor authentication, and SSL encryption to safeguard users’ personal information.

BTC Markets also implement what is known as a full reserve strategy for both Bitcoin and fiat funds. All Bitcoin owned by clients is kept within cold storage which is encrypted and dispersed across multiple off-site locations. BTC reconciliations are made twice a day to ensure that the reserve stays full. The same process is done for AUD with an hourly reconciliation frequency.

Are BTC Markets Fees Competitive?

Deposit & Withdrawal Fees

BTC Markets does not charge a fee to deposit AUD or cryptocurrency into the exchange or withdraw AUD from the wallet into an Australian bank account. Withdrawals of cryptocurrency will incur a standard network transaction fee based on the blockchain network load.

Trading Fees

BTC Markets uses a maker and taker fee model for traders on the exchange that are conducting crypto-to-crypto transactions. The maker and taker trading fees are -0.05% and 0.2%, respectively, and are limited to trading pairs comprising LTC-BTC, ETH-BTC, and XRP-BTC.

A tiered-fee structure applies for AUD pairs that vary between 0.10% and 0.85% depending on the volume traded. The trading fees are quite reasonable for high net worth investors only, where for example, amounts of $90,000 to $115,00 will attract a 0.4% fee. However, fees increase with smaller volumes where amounts of less than $500 incur a 0.85% fee. This is not ideal for beginner investors who typically trade smaller amounts. Users that are looking to maximize the deposit should consider a cheaper option such as Swyftx (0.6%) or Digital Surge (0.5%).

| TRADE VOLUME | FEE |

|---|---|

| < $500 | 0.85% |

| $500 – $1,000 | 0.83% |

| $1,000 – $3,000 | 0.80% |

| $3,000 – $9,000 | 0.75% |

| $9,000 – $18,000 | 0.70% |

| $18,000 – $40,000 | 0.65% |

| $40,000 – $60,000 | 0.60% |

| $60,000 – $70,000 | 0.55% |

| $70,000 – $80,000 | 0.50% |

| $80,000 – $90,000 | 0.45% |

| $90,000 – $115,000 | 0.40% |

| $115,000 – $125,000 | 0.35% |

| $125,000 – $200,000 | 0.30% |

| $200,000 – $400,000 | 0.25% |

| $400,000 – $650,000 | 0.23% |

| $650,000 – $850,000 | 0.20% |

| $850,000 – $1,000,000 | 0.18% |

| $1,000,000 – $3,000,000 | 0.15% |

| $3,000,000 – $5,000,000 | 0.13% |

| > $5,000,000 | 0.10% |

The AUD market pairs currently available comprise BTC-AUD, LTC-AUD, ETH-AUD, XRP-AUD, POWR-AUD, OMG-AUD, BCH-AUD, BSV-AUD, BAT-AUD, XLM-AUD, ENJ-AUD, LINK-AUD, COMP-AUD, ALGO-AUD, MCAU-AUD, and USDT-AUD.

Withdrawal Fees

BTC Markets do not charge fees to withdraw AUD from the account wallet. However, withdrawal fees will be incurred if crypto is withdrawn from the account and onto the user’s cold-storage wallet. The fees are shown below however may vary depending on network congestion.

| CRYPTO | FEE | CRYPTO | FEE |

|---|---|---|---|

| BTC | 0.0003 BTC | BSV | 0.0001 BSV |

| LTC | 0.001 LTC | GNT | 55 GNT |

| ETH | 0.005 ETH | BAT | 20 BAT |

| ETC | 0.001 ETC | XLM | 0.01 XLM |

| XRP | 0.01 XRP | ENJ | 14 ENJ |

| POWR | 54 POWR | LINK | 0.6 LINK |

| OMG | 2 OMG | COMP | 0.035 COMP |

| BCH | 0.0001 BCH | ALGO | 0.01 ALGO |

| MCAU | 0.0003 MCAU | USDT | 20 USDT |

Accepted Countries

BTC Markets is only available to traders and investors residing in Australia. Persons located in other countries around the world will need to seek an alternative exchange where additional fiat currencies are supported.

Getting Started

Account Creation and ID Verification

BTC markets have made creating a basic account (with which you can explore the platform’s features) as simple as possible. All that is needed is an email address and a password.

Before deposits can be made, customers will need to verify their identity using an Australian passport or driver’s license. In our experience, the time to complete this process was approximately 10 minutes and substantially longer than other exchanges.

Deposit Methods

BTC Market users are able to deposit AUD funds into their account using PayID or BPAY. Both methods are supported by most Australian banks. Funds transferred using PayID will be completed almost instantly, however, a 1 to 3 business wait may be required for BPAY. In comparison to other popular exchanges, the number of deposit methods is limited. The use of credit/debit cards or POLi is not supported.

The User Experience

Buying Crypto

Buying crypto on BTC Markets is simplistic and resembles the buying process of other Australian-based exchanges. The buy/sell section can be easily found on the user trading interface. Users can then enter the amount of cryptocurrency they want to buy or the amount of AUD they wish to spend. The amount of crypto to be returned including the associated fee will be presented for review before confirming the transaction.

Trading Interface

BTC markets offer a high-performance trading interface with the charting package that most top-tier exchanges use: TradingView. Along with providing equity, high volume transaction processing, and automated trading systems, there are a number of advanced order types and technical analysis tools that experienced traders will be satisfied with.

The renowned charting package TradingView offered by BTC markets is undoubtedly one of its major selling points as it gives the full range of trading capabilities for serious traders to optimize their investments. Given that some investors will want to take advantage of the low fees on large volume trades, an advanced trading interface is a big bonus as serious investors can analyze and optimize their investments to their heart’s desire.

Customer Support & Reviews

Although the sample size is considered to be small, the 67 reviews of BTC Markets on TrustPilot indicate mixed feedback from customers. The majority of reviews were categorized as ‘excellent’ or ‘bad’ resulting in a polarized reflection of the platform’s performance. The overall rating of BTC Markets was 2.5 / 5.0.

Like many exchanges, BTC Markets provide a comprehensive FAQ section that will be helpful for the most common questions. A live chatbot however users can submit a ticket to the customer support team.

Mobile App

BTC Markets do not currently have a mobile app that is suitable for iOS or Android devices. The website however is mobile-friendly. If a mobile app is an important consideration, then an alternative exchange that allows its customers to access their trading via their mobile device will need to be sought.

BTC Markets Alternatives

The deep liquidity of BTC Markets order book is a strong attractant to traders and investors alike. However, the features found on BTC Markets can be sought from other Australian-based exchanges. Crypto exchanges like BTC Markets with similar features are:

- Swyftx (best Australian exchange overall). Available for Australian and New Zealand investors and traders, the platform has a wide variety of features including a sleek interface and customizable dashboard, low trading fees (0.6%), and TradingView charting.

- Digital Surge (best for beginners). Digital Surge is a beginner-friendly platform that possesses almost all of the products and services that BTC Markets offers. The trading fees are lower (0.5%), a similar number of supported digital assets (300+), and it provides a few innovative features including in-built tax tools and the ability to pay Australian bills with Bitcoin.

- Independent Reserve – Independent Reserve is a trusted Australian exchange with a strong reputation for providing excellent OTC and SMSF services. Beginners can deposit and use AUD to buy 27 digital currencies on a simple and easy-to-use platform.

- Cointree (suitable alternative for beginners). A solid choice for beginners and intermediate investors who don’t need advanced trading features.

- High-net traders might find the Peer-to-Peer (P2P) marketplace of Elbaite to be appealing. The non-custodial nature of the platforms means that the cryptocurrencies or not held or stored by the platform, thus providing a unique layer of additional fund security.

- ZipMex – ZipMex is a young crypto brokerage that focuses on the Australasian market with offices in Australia, Indonesia, Singapore, and Thailand. The platform has very competitive trading fees (0.2%) and excellent interest-earning features.

Frequently Asked Questions

Does BTC Markets Offer SMSF Investing?

BTC Markets allows Australians to use their Super Fund (SMSF) to purchase cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and several others. The tiered fee structure favors large volume trades and will suit investors using their SMSF to buy cryptocurrency.

Do BTC Markets Offer Staking?

As of April 15, 2021, BTC Markets incorporated a staking feature on their platform. Currently, the only cryptocurrency you can stake is Algorand (ALGO). To qualify for staking, traders are required to hold at least a minimum of 1 ALGO. Staking rewards will be automatically deposited into your account.

Does BTC Markets Have An Affiliate Program?

Unlike many other popular Australian exchanges, BTC Markets does not appear to offer a referral bonus for inviting new friends or an affiliate program.

Our Verdict

BTC Markets is a sound choice for beginner and intermediate users. However, it is hard to see what the standout features are to attract such users. Other Australian-based exchanges provide the same features with fewer fees. Beginners in particular are more likely to opt for a more popular exchange.

Based on our review, experienced high-volume traders and investors would benefit from the deep liquidity resulting in low spreads, as well as the very competitive trading fees associated with large transaction amounts.

Did You Find What You Were Looking For?

Swyftx vs Crypto.com 2023: Which Is Better For Aussies?

Updated 02 Feb, 2023

There are quite a lot of differences in the crypto service offerings of Swyftx and Crypto.com. Which platform best suits your individual crypto needs?

Best Places To Earn Crypto Interest In Australia

Updated 02 Feb, 2023

There aren't too many options for Aussie to earn interest on their crypto, however, there is one local exchange that provides great rates on popular assets.

Digital Surge Referral Code – Claim Your Free $10 BTC

Updated 02 Feb, 2023

Our Digital Surge referral link will net you $10 free of Bitcoin upon creating a new account. Click here now to avoid missing out.