Table of Contents

The creation, trading, and use of cryptocurrencies are rapidly evolving and can be quite complicated for the everyday investor or trader. With blockchain technologies becoming more mainstream and crypto more accessible, it is important to understand what the tax implications are for your held assets and any legal obligations it may bring.

The level of attention to detail and scrutiny on the responsibilities that crypto users have has also increased in recent years. The Australian Tax Office (ATO) and reputable Australian-based crypto exchanges currently engage in a data-sharing program where user accounts and transactional data are made transparent.

In this article, we break down everything you need to know about how crypto is regarded by the Australian Tax Office and how they are taxed.

The information contained in this article is not intended to act as legal advice, tax advice, or financial advice. Cryptocurrency investors and traders should seek professional advice when working through their cryptocurrency taxation obligations and requirements.

The ATO Standpoint

From the standpoint of The Australian Tax Office (ATO) use the term cryptocurrency to describe a digital asset where encryption techniques are used to regulate the generation (mining) of additional units and verify transactions on a blockchain. From the ATO standpoint, cryptocurrencies are considered assets or property and they are therefore subject to Capital Gains Tax (CGT).

In Australia, the regulatory environment has been relatively progressive compared to other countries. Alongside this, the ATO have regularly reminded Australian investors and traders that all gains and losses must be reported on their tax return. In March 2020, the ATO notified 350,000 crypto users that financial gains made from crypto are subject to CGT and must be reported. A period of 28 days was given for recipients to disclose their crypto trades.

In May 2021, approximately 100,000 Australians received correspondence from the ATO outlining their tax obligations and urging them to review their previously submitted tax returns. The ATO indicated that the root cause appeared to be misconceptions, specifically that crypto gains are tax-free or only taxable when the assets are cashed in for Australian dollars.

Investor Or Trader?

In Australia, how cryptocurrencies are taxed depends on how the ATO perceives you as a crypto investor or trader. So what’s the difference?

Investor: An investor is an individual who buys and sells crypto over a long period with the intention of benefiting from capital gains (increased value). Most Australians who hold crypto fall into this category. In most cases, CGT will apply and investors will be able to access the 50% CGT discount. Depending on how the crypto was acquired, Income Tax may also apply.

Trader: A trader who actively generates income through a business where transactions are performed in a business-like manner for commercial purposes. Crypto-generated profits will be subject to Income Tax. Businesses that fall into this category include exchanges (excluding ATMs), crypto trading platforms, mining businesses, or companies that regularly buy and sell for short-term gains.

How Does The ATO Know About Your Cryptocurrencies?

The ATO will be aware of all cryptocurrency transactions made on Australian-based Designed Service Providers (DSPs), which include crypto exchanges, brokerages, third-party payment providers, and other crypto-related businesses. In April 2019, a data-matching program was launched between the ATO and all Australian exchanges. The ATO has since collected cryptocurrency transaction data dating as early as the 2014-2015 financial year. The ATO can compare the information contained within the lodged tax documentation against the transactions made through the exchange.

All Australian cryptocurrency exchanges are required to provide the ATO with the Know-Your-Customer (KYC) information that customers input when verifying a crypto account. The KYC process is a requirement that exchanges must follow under AUSTRAC regulations.

Capital Gains Tax

When Is Crypto Subject to CGT?

Capital Gains Tax (CGT) is generally associated with the activities of crypto investors who buy, sell and hold crypto in the hope that it gains value or appreciates over time. Under current ATO regulations, CGT applies in the event where financial gains are achieved through the sale or disposal of crypto, including:

- Selling crypto (if there is a net financial gain).

- Trading or swapping crypto, i.e. crypto-crypto transactions where one asset is disposed to acquire another asset.

- Converting crypto to a fiat currency, e.g. AUD.

- Use crypto to obtain goods or services.

- Providing crypto as a gift.

If the capital gain is achieved on the disposal of cryptocurrency, then a portion or all of the gain may be subject to CGT. Alternatively, certain capital gains or losses that are considered personal use assets may be exempt.

Investors who hold crypto for more than one year before disposing of will attract a 50% discount on CGT. A 33.33% discount may apply if the investors comply with super funds or life insurance companies. Persons who are regarded by the ATO as traders are not eligible for the discount.

When is Crypto Free of CGT?

There are several scenarios where cryptocurrencies will not be subject to CGT. Examples of these scenarios are listed below:

- Buying crypto using AUD or another fiat currency.

- Holding crypto (until it is traded or sold).

- Token and coin swaps.

- Acquiring crypto as a gift.

- Acquiring crypto from hobby-level crypto mining.

- Transferring crypto from one wallet to another wallet.

- Buying goods and services using crypto and if the amount is less than under $10,000. This will be considered a personal use asset and therefore exempt from CGT.

- Donating crypto to registered charities.

Capital Losses

A capital loss occurs when a digital asset is sold for less than the price that it was bought for. Capital losses are not subject to CGT given that a profit was not made. It is important to note, that the net CGT amount can be reduced by deducting capital losses from capital gains.

Capital Gains Tax Rates

The CGT tax rates will vary depending on the total income generated during the financial year. For individual investors, the CGT tax rate will be consistent with the income tax rate for Australian residents. Tax rates for the 2021 – 2022 financial year are shown below and do not include the Medicare levy of 2%.

| TAXABLE INCOME | TAX RATE | TAX |

|---|---|---|

| < $18,200 | Nil | None |

| > $18,201 – <$45,000 | 19% | 19 cents for each $1 over $18,200 |

| > $45,001 – < $120,000 | 32.5% | $5,092 plus 32.5 cents for each $1 over $45,000 |

| > $120,001 – < $180,000 | 37% | $29,467 plus 37 cents for each $1 over $120,000 |

| > $180,000 | 45% | $51,667 plus 45 cents for each $1 over $180,000 |

Am I Eligible for Crypto Capital Loss?

A crypto capital loss claim is only allowed if a cryptocurrency private key or digital asset is stolen. To make a capital loss claim, the following evidence will be required:

- The date the private was acquired and lost.

- The wallet address of the private key.

- The cost incurred to acquire the lost or stolen crypto.

- The amount of crypto lost at the time of the loss of the private key

- Proof of ownership.

- Proof of possession of the hardware wallet.

- Transactions to the wallet from a crypto exchange.

Income Tax

Where CGT generally applies to investors, Income Tax generally applies to commercial traders. Traders will incur income tax in the following scenarios:

- Receiving a wage or salary in exchange for provided products and/or services.

- Staking rewards (like dividends)

- Airdrops associated with crypto promotion programs.

- DeFi interest (like bank account interest)

- Referral fees (like commission)

Cryptocurrency Tax Reporting

Tax Reporting Deadline

The reporting of crypto for tax purposes aligns with the reporting timeframe for the lodgement of all other tax information. That is, each financial year commencing from July 1 to June 30 in the following year. If you are lodging your crypto tax return, then it needs to be provided to the ATO no later than the last day of October. However, if an accountant or tax agent is preparing the lodgement on your behalf, then the deadline is March 31 the year following the financial year.

What Records Do I Need For Tax Reporting?

As usual, you need to keep certain records of your crypto activities, which should give the following information:

- Transaction date

- Crypto value at the specified date of transaction

- Purpose (personal use, gift, etc.)

- Details of the receiver or other party involved (can simply be the crypto wallet address)

We recommend keeping all receipts, exchange records, agent invoices, and digital keys or wallet records as evidence. Crypto tax records should be lodged in conjunction with your regular income tax.

Crypto Tax Calculators

There are several crypto tax calculators which are available to keep track of crypto transactions and wallet balances. CryptoTax and Koinly are platforms that have been designed around the current ATO regulations and produce a crypto capital gains report which calculates and presents the gains or losses during the financial year.

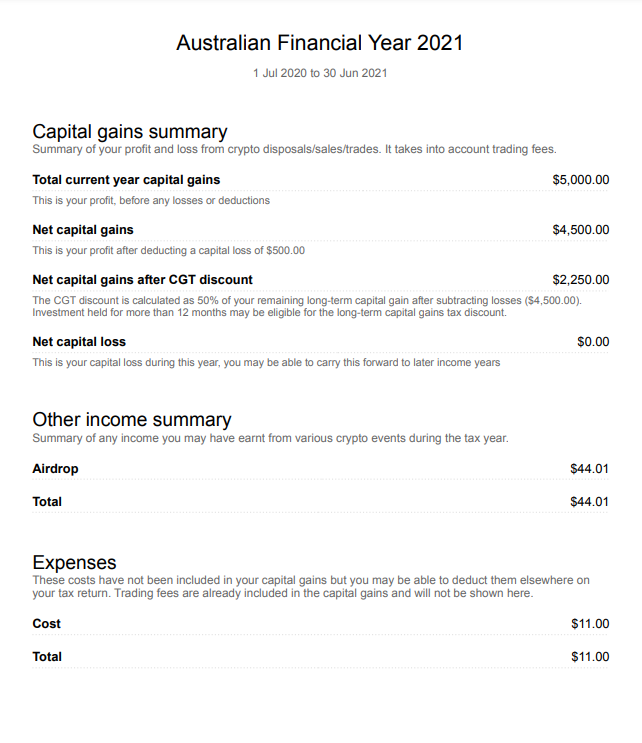

Several Australian-based crypto exchanges such as Swyftx, Digital Surge, CoinSpot, and Independent Reserve offer ways to quickly produce reports which summarise their transaction history to allow their customers to easily prepare their crypto tax returns without hassle. An example of a Koinly-produced crypto tax report is pictured below.

Final Thoughts

The taxation obligations of crypto investors and traders alike can seem quite complex and understanding legal responsibilities is a key facet to avoiding non-compliance. Whilst the regulatory framework is constantly evolving, the availability of tools and professional expertise has increased to provide crypto users and businesses to easily calculate and understand their crypto taxes.

Frequently Asked Questions

Can I Avoid Paying Tax On Crypto?

Capital or financial gains made from the buying, trading, or selling of crypto is subject to either Capital Gains Tax (CGT), or Income Tax depending on how the crypto was acquired. Since the Australian Tax Office (ATO) and Australian cryptocurrency platforms share account and transactional data, any discrepancies will be flagged and investors and traders will be notified. Instances, where crypto is not subject to CGT, include holding crypto as a long-term investment (unless sold or traded), or the crypto is considered as a personal use asset.

What Records Do I Need For Taxation?

Records and documents that should be retained during the financial year to support the lodgement of a crypto tax return include receipts of crypto purchases or trades, exchange records, records of an accountant or legal costs, digital wallet and key records, and any costs related to software tools that manage tax affairs. These records should be kept for at least 5 years.

How Much Tax Does A Crypto SMSF Pay?

Cryptocurrencies held as part of Self-Managed Super Funds (SMSF) are taxed at a maximum rate of 15%. If the assets are held for more than 12 months, the long-term tax rate is 10%.

For more information, you can read our Australian crypto SMSF taxation guide.

Did You Find What You Were Looking For?

Swyftx vs Crypto.com 2023: Which Is Better For Aussies?

Updated 02 Feb, 2023

There are quite a lot of differences in the crypto service offerings of Swyftx and Crypto.com. Which platform best suits your individual crypto needs?

Best Places To Earn Crypto Interest In Australia

Updated 02 Feb, 2023

There aren't too many options for Aussie to earn interest on their crypto, however, there is one local exchange that provides great rates on popular assets.

Digital Surge Referral Code – Claim Your Free $10 BTC

Updated 02 Feb, 2023

Our Digital Surge referral link will net you $10 free of Bitcoin upon creating a new account. Click here now to avoid missing out.