Huobi Review 2023: Features, Pros & Cons

Published 08 Dec, 2021 Updated 02 Feb, 2023

Table of Contents

- 1 Our Takeaways

- 2 What Is Huobi Global?

- 3 Huobi Global Pros & Cons

- 4 Top Huobi Features You Should Know

- 5 Where Is Huobi Regulated?

- 6 Huobi Security Measures

- 7 Huobi Fees

- 8 Supported Countries

- 9 Getting Started With Huobi

- 10 The User Experience

- 11 Customer Support & Reviews

- 12 Mobile App

- 13 Huobi Alternatives

- 14 Frequently Asked Questions

- 15 Our Verdict

Huobi Global has transformed itself from its Asian-focussed origins into one of the world’s best cryptocurrency exchange platforms. In this review, we will examine its products, services, and features that have catapulted the platform across the globe.

Promotion: None available at this time

Trading Fees: 0.2%

Available Cryptos: 567

We work with partners that may result in MoreCrypto earning a small commission. Read our affiliate disclaimer for further information.

Our Takeaways

Huobi Global is a leading global cryptocurrency exchange that provides a secure and safe platform for investors and traders to buy, trade, sell, earn and stake 560+ digital currencies. The platform offers innovative features that allow users to actively manage and grow their crypto portfolios.

| Name | Huobi Global |

| Core Services | Crypto spot trading, margin, futures, and derivatives trading, staking |

| Available Cryptocurrencies | 567 |

| Fiat Currencies | 57 fiat currencies including USD, AUD, GBR, EUR, RUB, JPY |

| Deposit Methods | 60 deposit methods including Advcash, cryptocurrency transfer, wire transfer, credit card |

| Deposit Fees | Depends on country and deposit method |

| Trading Fees | 0.2% |

| Withdrawal Fees | None |

| Mobile App | Yes (iOS and Android) |

What Is Huobi Global?

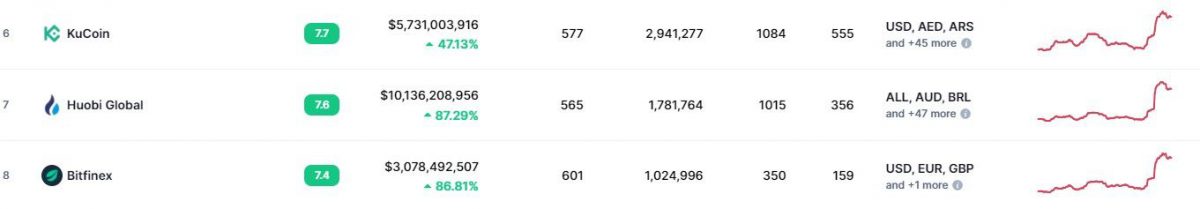

Established in 2013 by founder Leon Li, Huobi is now one of the world’s longest-serving and largest cryptocurrency exchanges. Over recent times, it has undergone several rebranding changes, and it’s now offered as Huobi Global. Huobi has expanded from its predominantly Asian-centric market and now offers its services in over 190 countries around the world. Global expansion and a growing reputation have resulted in the exchange being the #7 ranked exchange for traffic, trading volume, and liquidity. At the time of writing, the average daily trading volume was over USD$5.8 billion.

Huobi’s holding group and owner, Huobi Global, have offices in several countries including Japan, South Korea, Brazil, and Hong Kong. In 2018, the headquarters was moved to Seychelles after China banned cryptocurrency exchanges. Huobi is listed on the Hong Kong Stock Exchange (HKG:1611).

The exchange provides a sound platform for intermediate to professional investors and traders to obtain digital currencies. In addition to the large variety of supported altcoins and stablecoins, users can utilize the offered products and services to buy, swap, store, borrow, earn, stake, and sell cryptocurrencies.

Huobi Global Pros & Cons

Pros

- Ranked #7 in the world for traffic, liquidity and trading volume

- 560+ supported cryptocurrencies

- Low and competitive trading fees starting at 0.2%

- Easy to use mobile app for iOS and Android

- Vast array of supported fiat currencies and deposit methods

- 24/7 customer support

- TradingView charting and advanced tools and indicators

- 20,000 BTC reserve as contigency for security breaches

Cons

- Beginners may be overwhelmed by the number of complexity of features

- Not available to US residents

- The native coin, Huobi Token (HT), must be held to obtain trading fee discounts

Top Huobi Features You Should Know

Deep Liquidity

At the time of writing, Huobi is ranked #7 in the world for traffic, trading volume, and liquidity. The high liquidity means that traders are able to trade cryptocurrencies at lower spreads compared to smaller exchanges with lower liquidity where spreads will be wider. High liquidity also means that the order book market is more stable and results in less price slippage. The combination of a vast array of cryptocurrencies (560+) and high liquidity means that Huobi is an excellent platform for trading altcoins.

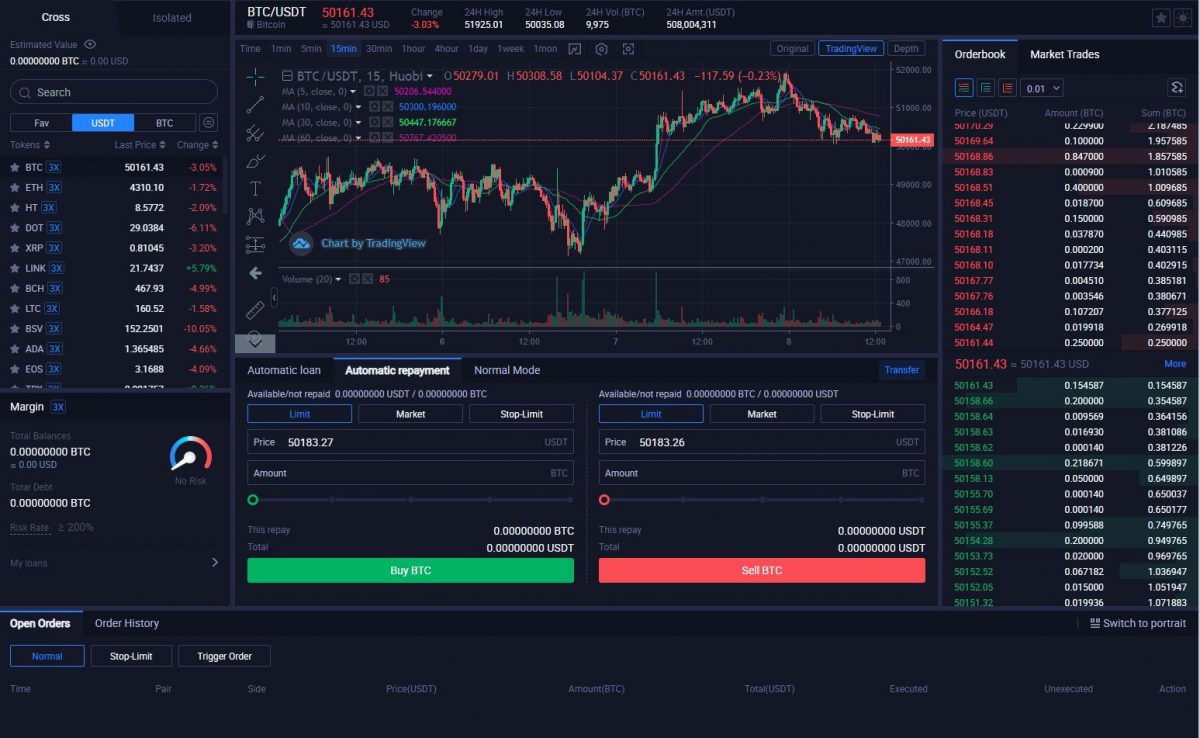

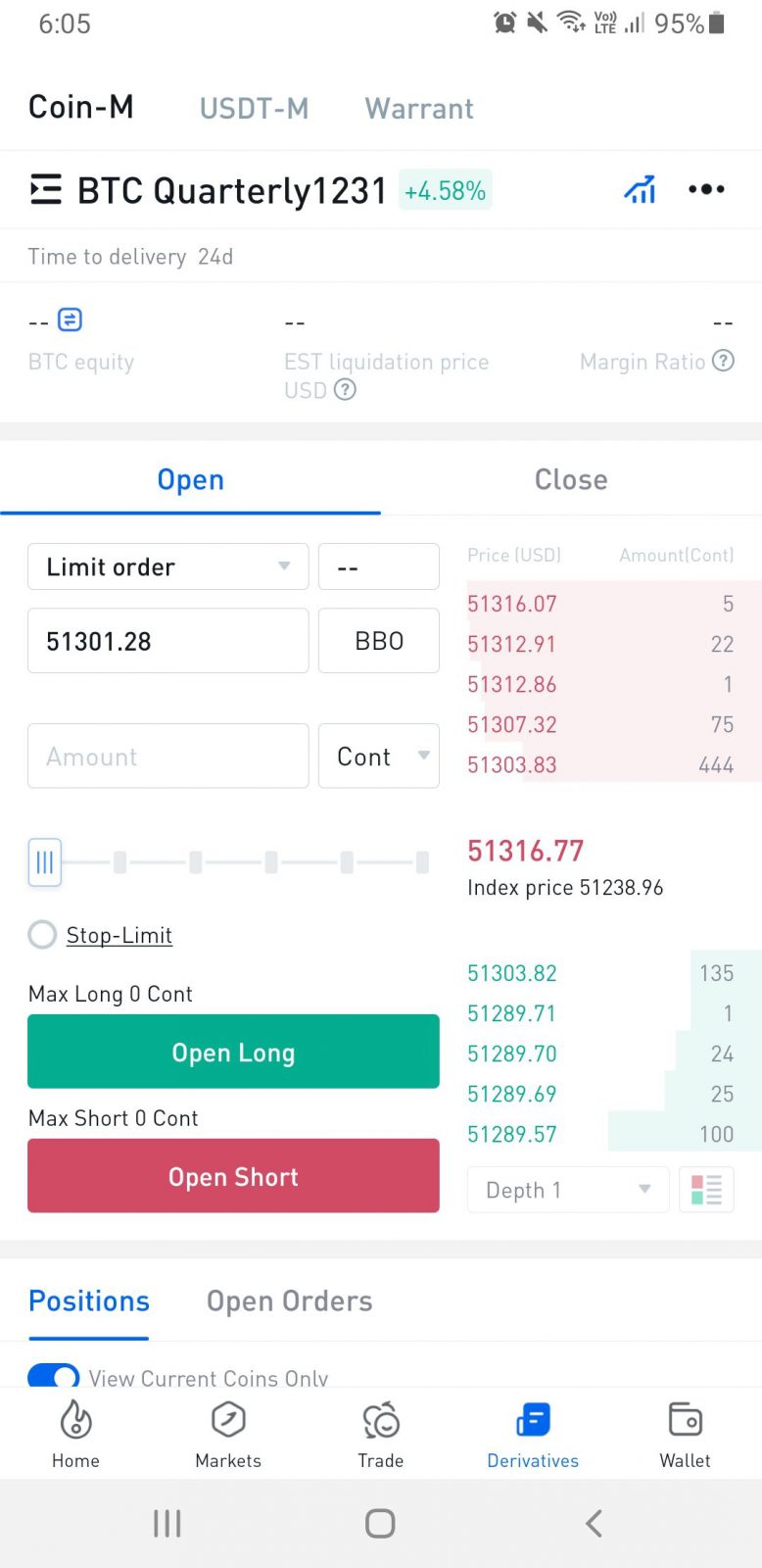

Derivatives, Margin & Futures Trading

Huobi offers a variety of cryptocurrency markets that can be traded using the same user account. Individuals can speculate on digital currencies using the Spot Exchange, Margin Exchange, Coin-margined Swaps, and Futures Market, with leverage up to 125x. The emergence of leverage crypto trading allows customers to hedge spot their positions by short-selling Bitcoin to balance a crypto portfolio and exposure to market conditions.

Huobi provides several markets to trade coins with leverage, including:

- Spot trading with leveraged margin up to 3x. There are currently 62 trading pairs against USDT, and 43 trading pairs against BTC.

- Coin-M Futures: USD is the base currency and open positions are closed with the arithmetic average of their last hour index prices.

- Coin-M Swaps: Similar to spot trading, coin-margined trading lets you take long or short positions where contracts have no expiration dates.

- USDS-M Contracts: Contracts that use USDT as the margin and have no expiration date. Profit/losses are settled every 8 hours.

With the suite of crypto products and services that Huobi offers to everyday traders and investors, Huobi is a great option for non-USA margin traders who are looking for a one-stop-shop for all their crypto needs.

Stake Coins For Rewards

Huobi offers coin staking for several cryptocurrencies where investors can earn between 3.5% and 15% Annual Percentage Yield (APY). Whilst Huobi offers some of the highest yielding APY in the market, the number of digital currencies that can be staked is limited to ELF, LUNA, SOL, XPRT, and CSPR. Huobi has made staking easy and it is essentially a “one-click” process. Rather than having to transfer coins to be staked into a separate wallet, Huobi locks the staked crypto in the user’s account and they are only accessible once the fixed staking period ends.

Overall, the number of cryptos that can be staked is very low compared to other major exchanges. For example, Binance supports the staking of over 40+ cryptocurrencies including, DAI, SOL, DOT, BNB, USDT, and SHIB. Huobi is constantly announcing the addition of new coins that can be staked through their support page.

Huobi also offers support for the Ethereum 2.0 network upgrade to a Proof-of-Stake (POS) consensus model. Users can deposit Ethereum to a fixed wallet to earn ETH 2.0 staking rewards. The rewards can only be redeemed once the Ethereum upgrade has been completed.

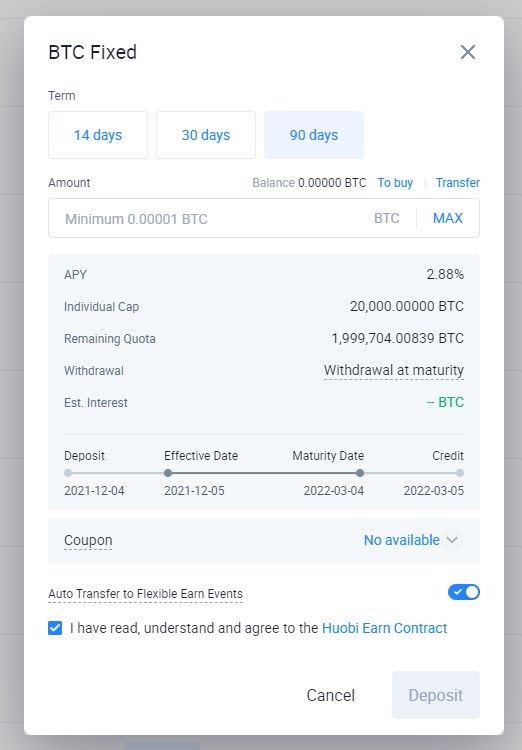

Huobi Earn

Users who complete registration and ID verification are eligible to invest their crypto with Huobi Earn. Flexible and fixed-term arrangements are offered where interest rewards of up to 5% APY and 6.5% APY can be earned, respectively.

The lock-in period for a fixed-term arrangement depends on the coin deposited and ranges between 7 and 90 days. Crypto that is deposited into the Huobi Earn wallet is not accessible for other trading purposes and investors will need to wait for the lock-in period to end where the interest is redeemed. Due to the decreased flexibility associated with locked assets, the APY % is typically higher to compensate.

Investors who want to see asset growth but retain control will benefit from placing their crypto into a flexible wallet. There are no lock-in periods and the deposited assets can be withdrawn at any time. Interest rewards are compounded daily.

Users should note that Huobi Earn is not available to investors from China, the United States, and Japan, as well as other countries or regions where limitations have been placed by governments on cryptocurrency investments.

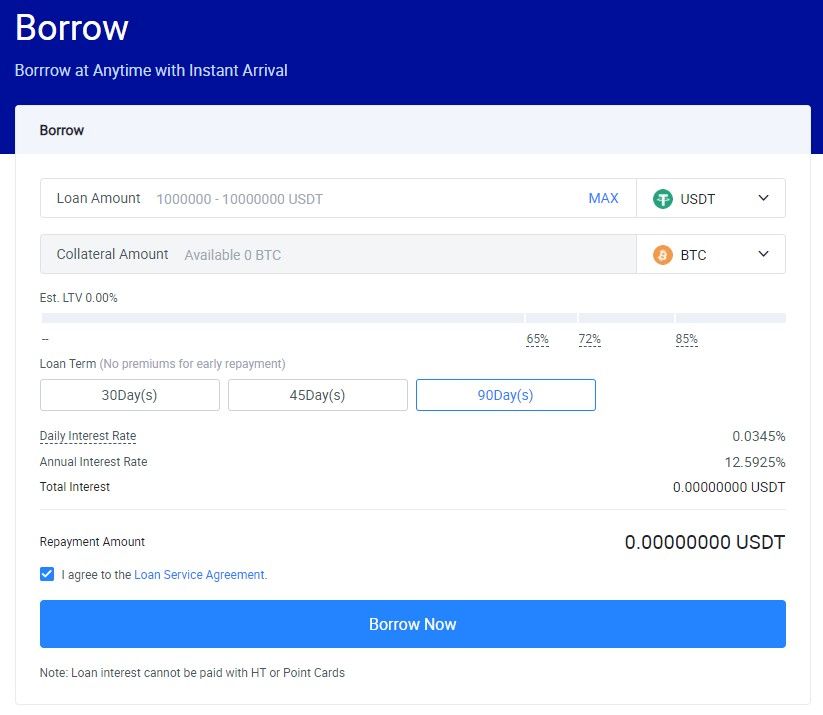

Huobi Crypto Loan

Users who complete registration and ID verification are eligible to use their crypto as collateral and borrow other cryptocurrencies to meet their trading needs. Crypto that is supported as collateral includes BTC, USDT, ETH, HUSD, HT, FIL, LTC, BCH, EOS, LINK, BSV, XRP, DOT, ETC, ADA, DOGE, and HDT. Huobi supports a wide range of crypto that can be borrowed including but not limited to BTC, DOGE, and ETH.

Once a loan account is opened, interest accrues on an hourly basis. Interest rates differ for each coin borrowed and the length of the loan term. Loan terms also differ for each coin but durations of 30, 45, and 90 days are common. Interest and principal payments can be made anytime with the interest paid first.

Before committing to a loan, users will be able to assess the Loan to Value (LTV) ratio which is presented on the order panel. If the LTV is higher than the margin call LTV, then the user will be notified by Huobi to deposit more collateral.

Huobi allows a period of 7 days following the loan term for users to complete loan repayment. During this overdue period, 3 times the interest will be charged. If repayment is still not made then the collateral will be liquidated by Huobi.

Where Is Huobi Regulated?

Huobi appears to be a licensed and regulated cryptocurrency services provider that complies with the local legal and regulatory requirements in the 190 countries it operates. Due to strict regulatory reasons, Huobi is not available to residents located in the United States, mainland China, Canada, Japan, Iran, North Korea, Singapore, and Syria. Huobi Global is committed to complying with local and international regulations to provide a regulated and safe trading platform for its users.

Huobi Security Measures

Huobi is a safe and secure cryptocurrency exchange platform that has not experienced a security breach that has resulted in the loss, damage, or theft of digital assets or funds. 98% of customer funds and assets are held in independent cold-storage wallets with multi-signature procedures implemented to safeguard against internal authority errors. Customers can also activate Two-Factor Authentification (2FA) to provide another form of verification and layer of account security.

In February 2018, Huobi Global launched the Investor Protection Fund which serves as a reserve contingency fund. The reserve contains 20,000 BTC which is owned by Huobi, stored at an independent location, and is intended to be used as compensation in the event of significant security breaches.

Huobi Fees

Spot Trading Fees

Huobi charges a base trading fee of 0.2% for crypto-to-crypto transactions. This is fairly competitive in the crypto market but is slightly higher than other global exchanges such as Binance where trading fees start at 0.1%.

Users who hold the Huobi native coin, Huobi Token (HT), may be eligible to receive discounts on their trading fees. Trading fees discounted are based on a tiered system where the base fee of 0.2% can be reduced by 65% to 0.07%. For example, if 600 HT is held in the user’s wallet, then their trading is reduced from 0.2% to 0.12%.

| LEVEL | HT HOLDINGS | FEE | DISCOUNT |

|---|---|---|---|

| 1 | ≥ 10 HT | 0.18% | 10% |

| 2 | ≥ 100 HT | 0.16% | 20% |

| 3 | ≥ 500 HT | 0.12% | 40% |

| 4 | ≥ 1,000 HT | 0.09% | 55% |

| 5 | ≥ 2,000 HT | 0.08% | 60% |

| 6 | ≥ 5,000 HT | 0.07% | 65% |

Exchange Trading Fees

Professional trader fees are based on a tiered system which starts at 0.04% for maker and 0.05% for taker orders. Similar to the spot trading fees, fees can be reduced if at least 2,000 HT is held and the BTC trading volume over the past 30 days is greater than 1,000 BTC. The maker/taker fees are very competitive and will suit high-net traders.

| LEVEL | BTC 30-DAY TRADING VOLUME | HT HOLDINGS | MAKER | TAKER |

|---|---|---|---|---|

| 1 | ≥ 1,000 BTC | ≥ 2,000 HT | 0.0362% | 0.0462% |

| 2 | ≥ 1,500 BTC | ≥ 2,000 HT | 0.0294% | 0.0420% |

| 3 | ≥ 5,000 BTC | ≥ 2,000 HT | 0.0294% | 0.0378% |

| 4 | ≥ 10,000 BTC | ≥ 2,000 HT | 0.0252% | 0.0336% |

| 5 | ≥ 15,000 BTC | ≥ 2,000 HT | 0.0224% | 0.0308% |

| 6 | ≥ 20,000 BTC | ≥ 2,000 HT | 0.0210% | 0.0294% |

| 7 | ≥ 40,000 BTC | ≥ 2,000 HT | 0.0168% | 0.0252% |

| 8 | ≥ 80,000 BTC | ≥ 2,000 HT | 0.0126% | 0.0210% |

| 9 | ≥ 150,000 BTC | ≥ 2,000 HT | 0.0097% | 0.0193% |

Supported Countries

Huobi Global is available to cryptocurrency investors and traders in over 190 countries worldwide. Due to strict regulatory reasons, Huobi is not available to residents located in the United States, mainland China, Canada, Japan, Iran, North Korea, and Syria. Singaporean-based accounts will be gradually phased out by early 2022, with Huobi Singapore to establish its presence as a regulated digital assets exchange platform.

Several Huobi products and services are also restricted in certain countries and regions. For example, Huobi Earn is not available to investors from China, the United States, and Japan, as well as other countries or regions where limitations have been placed by governments on cryptocurrency investments. Futures and derivatives trading is restricted for people located in China, Taiwan, Israel, Iraq, and retail investors in the United Kingdom. There are 37 countries where EUR and GBR cannot be used as a fiat currency to buy crypto via credit cards.

Investors and traders located in the UK and US will need to find an alternate cryptocurrency exchange in the United Kingdom and the United States.

Getting Started With Huobi

Creating & Verifying An Account

Creating and verifying an account with Huobi took a few minutes. To get started, a valid email address and a strong password will be required. Similar to other major cryptocurrency exchanges, ID verification is required as part of Know Your Customer (KYC) protocols. One government-issued document can be submitted using a smartphone which can also be used to satisfy the biometric facial recognition test.

Deposit Methods & Limits

Huobi supports 90 deposit methods to fund the user’s wallet however the available methods differ from country to country. The full list of deposit methods can be viewed here. Before funds can be deposited into the wallet, ID verification must be completed.

The User Experience

The Huobi trading interface is one of the most advanced interfaces on the market. The various panels and tools are clearly laid out and visually pleasing without sacrificing functionality. The live charting is powered by TradingView and provides traders with a suite of advanced indicators (e.g. advance/decline, ratio, average price, and oscillators) and tools to make the most out of their trades.

The bottom panel can be used to check the status of current positions, orders, and the history of orders and trades. Trigger orders (limit orders and market orders) can be selected to act as risk management tools. The trigger order means that when the latest market transaction price reaches the trigger conditions, the system will automatically execute the order.

Customer Support & Reviews

Huobi features a comprehensive library of articles and how-to guides to provide its customers with informational support. Articles to assist users with the knowledge to troubleshoot issues or provide assistance were mixed with promotional announcements which made navigating categorizes a bit difficult. Rather than look for articles, we found the search function to be more useful. Whilst the information library was lacking in practicality, the 24/7 chatbot was significantly more useful, and finding an answer was a simple and straightforward process.

Social commentating and feedback on social media platforms such as Facebook, Twitter, and Telegram were generally positive.

Mobile App

The Huobi Global platform is available for users to access on their iOS and Android mobile devices. The app is quick, responsive, and clearly laid out, and allows users to use nearly all the features that are available on the desktop. Staking and obtaining a crypto loan with Huobi did not appear to be available on the app. A nice feature is the ability to set up biometric fingerprint access to provide an additional layer of account security. With the Huobi mobile app, users can:

- Buy and sell over 348+ digital currencies on the exchange or the Peer-to-Peer (P2P) marketplace.

- Track real-time crypto market prices view live charting and set up trigger orders.

- Trade on leverage in Futures or Margin trading.

- Use the Huobi Earn feature

- Obtain instant assistance from the 24/7 live bot chat.

The Huobi Global app has received an overall score of 3 stars based on over 19,000 customer reviews. Positive reviews are generally related to the smooth user experience. Customer feedback that was critical of the app generally revolves around minor and annoying glitches and errors.

Whilst the Huobi Global mobile app is robust, easy to use, and responsive with excellent security features, we found that some Huobi services including staking and crypto loans were not available. Users who want to access a full suite of innovative crypto products and services on the go may wish to consider Crypto.com. Crypto.com is considered as one of the premium mobile apps that provides an ecosystem of features and high-level security.

Huobi Alternatives

Huobi Global is a popular derivatives trading platform that operates in over 190 countries. Traders, including those located in the United States, who are considering alternatives to Huobi, may opt for one of the following reputable exchanges.

- FTX – FTX and FTX.US is an advanced cryptocurrency platform for futures, spot, and leveraged tokens where up to 101x leveraged can be achieved. The platform offers cutting-edge features including advanced charting, tools, and indicators with TradngView.

- Binance – Binance offers margin trading or futures trading to speculate on the price of digital assets with leverage. Compared to regular trading, margin trading allows users to access greater sums of capital with leveraged positions.

- Crypto.com – Crypto.com is a global crypto exchange that is well-known for its ecosystem of innovative products and services that make it a one-stop shop for crypto users. The Crypto.com mobile app has been downloaded by over 100 million users and allows customers to buy, sell crypto, stake, earn interest, and shop using their digital currencies.

- Bybit – Bybit is a leading cryptocurrency derivatives exchange with an emphasis on leveraged margin trading. The platform has attracted over 3 million users and offers an advanced trading interface full of high-level features.

- KuCoin – is a hugely popular crypto platform that targets experienced traders. KuCoin is not available to US users due to regulatory reasons. The exchange offers 593 digital currencies to trade, low trading fees, and advanced trading features such as spot, futures, and derivatives.

Frequently Asked Questions

Is Huobi Global Legit?

Huobi Global is a legitimate cryptocurrency exchange platform that is licensed and regulated to provide cryptocurrency services in each of the jurisdictions that it operates in. The exchange complies with local government regulations and has a track record in adapting to changing regulatory environments to ensure compliance. According to Elaine Sun, Compliance Director of Huobi Technology, “As part of our global expansion strategy, we at Huobi plan to continue to evolve our operations to meet the requirements of the regulatory environment.“.

Is Huobi Available In The USA?

Huobi is not licensed to operate in the United States as a cryptocurrency exchange platform. Investors and traders residing in the US will need to find an alternative digital assets platform that is regulated under US laws and regulations such as Binance, FTX, Gemini, or Kraken.

Can Australians Use Huobi?

Huobi is available for Australian investors and traders to deposit AUD and buy crypto using a VISA/Mastercard, POLi, or PayID. Withdrawals can only be made as cryptocurrencies. Investors who want to withdraw funds as AUD will need to seek an alternative Australian-based cryptocurrency exchange that supports this.

What Is The Huobi Token?

The Huobi Token (HT) is the native digital currency of the Huobi Global exchange platform. The coin is hosted on the robust and secure Ethereum blockchain network and has a limited supply of 500 million. The coin acts as a loyalty point system that is integrated into many Huobi features. Huobi users can buy and hold the asset to obtain trading fee discounts, voting rights for new coin listings, as well as provide VIP Sharing Program access.

Our Verdict

Huobi Global has fast become one of the world’s largest and widest spanning cryptocurrency exchanges. From its China-beginnings, the global expansion of the exchange has primarily been related to its adaption to the ever-changing regulatory landscape. The exchange continues to comply with local regulations in each of the jurisdictions that it operates in to ensure a safe and secure platform for its customers.

Huobi offers a vast selection of over 560+ digital currencies to choose from. and the quality of its innovative features is top-shelf. Its trading fees are very competitive in the global crypto market and can be reduced further if the native HT coin is held. The platform is better suited for intermediate to professional investors and traders.

Did You Find What You Were Looking For?

Swyftx vs Crypto.com 2023: Which Is Better For Aussies?

Updated 02 Feb, 2023

There are quite a lot of differences in the crypto service offerings of Swyftx and Crypto.com. Which platform best suits your individual crypto needs?

Best Places To Earn Crypto Interest In Australia

Updated 02 Feb, 2023

There aren't too many options for Aussie to earn interest on their crypto, however, there is one local exchange that provides great rates on popular assets.

Digital Surge Referral Code – Claim Your Free $10 BTC

Updated 02 Feb, 2023

Our Digital Surge referral link will net you $10 free of Bitcoin upon creating a new account. Click here now to avoid missing out.