Kraken Review 2023: Is It A Trustworthy Exchange?

Published 30 Oct, 2021 Updated 02 Feb, 2023

Table of Contents

- 1 Our Takeaway

- 2 What Is Kraken?

- 3 Pros & Cons

- 4 Top Kraken Features You Should Know

- 5 Is Kraken Regulated?

- 6 Security Features

- 7 What About The Fees?

- 8 Accepted Countries

- 9 Getting Started With Kraken

- 10 Is Kraken Easy To Use?

- 11 Customer Support & Reviews

- 12 Mobile App

- 13 Kraken Alternatives

- 14 Frequently Asked Questions

- 15 Our Verdict

Kraken is one of many cryptocurrency buying and trading platforms that are truly global, serving investors and traders in over 190 countries. But how does Kraken set itself apart from its competition?

There are several considerations that should be made before committing to global exchange. In this review, we will take a look at the Kraken fee structure, reputability, security infrastructure, measures, and customer service.

Promotion: None available at this time

Trading Fees: 0.16% (maker) and 0.26% (taker)

Available Cryptos: 102

We work with partners that may result in MoreCrypto earning a small commission. Read our affiliate disclaimer for further information.

Our Takeaway

Kraken is suitable for novice investors who possess a basic crypto background and intermediate to experienced investors who want to maximize their trading performance using the advanced features of Kraken Pro. The platform supports a modest list of 36 high-capitalization coins to margin trade with up to 5x leverage and is one of the better margin trading platforms available in the US.

| Exchange Name | Kraken |

| Core Services | Fiat-to-crypto, futures/margin trading, staking |

| Available Cryptocurrencies | 102 |

| Deposit Options | Etana/Swift, PayID/OSKO, Bank transfer |

| Deposit Fees | None |

| Trading Fees | 0.16% (maker) and 0.26% (taker) |

| Withdrawal Fees | None |

| Mobile App | Yes (iOS and Android) |

What Is Kraken?

Established in 2011, Kraken is one of the longest-serving cryptocurrency exchanges in the world. In terms of trading volume, Kraken is one of the largest cryptocurrency exchanges which provides a secure way to buy, trade, and sell crypto in over 190 countries around the world.

The top-rated US-based crypto exchange offers a number of features that are not offered by many other platforms. Some of these include futures/margin trading, staking, and the ability to trade on multiple exchanges through a single platform. Investors who want to maximize their portfolios through the use of advanced trading features will find Kraken to be appealing.

Pros & Cons

Pros

- Well established and regulated platform

- Buy, trade and sell 102 different cryptocurrencies

- Advanced charting tools and display

- Margin/futures trading available

- Earn passive rewards by staking coins

Cons

- Margin trading fees a little high

- Complex fee structure

- Deposits/withdrawals can be slow

Top Kraken Features You Should Know

Deep Liquidity In Order Books

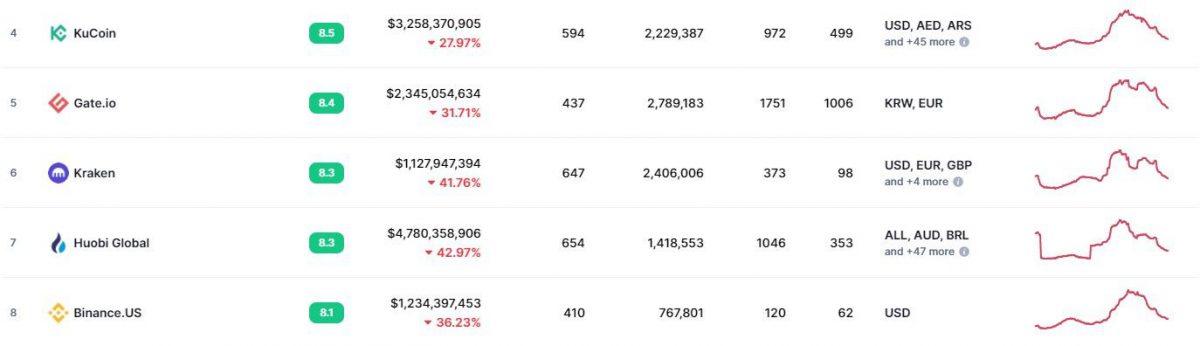

Kraken is ranked 6th in the world for trading volume alongside other large exchanges Gate.io and Huobi Global. This means that it is able to access high liquidity in its order books. The high liquidity means that is easier for fiat-crypto and crypto-crypto trading pair transactions to be executed with minimal market price slippage.

Margin Trading

One of Kraken’s main selling points is its margin trading platform, which has undoubtedly been a big reason it has become so well known. Their margin trading platform is suited to users of all experience levels and is, in many ways, the benchmark for margin trading in the crypto sphere.

Margin trading essentially allows traders to trade cryptocurrencies with borrowed funds. Based on the initial investment (i.e. margin), the user is eligible for a certain amount of added leverage. Kraken allows up to 5x leverage on its margin trading platform. Cryptocurrencies that can be leveraged include Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Tether (USDT), Litecoin (LTC), Ethereum Classic (ETC), Monero (XMR), Augur (REP), Tezos (XTZ), Cardano (ADA), and more.

Futures Trading

Kraken is one of the few platforms that offer futures crypto trading. This is generally a feature for experienced traders only. The option lets a user buy or sell crypto assets on a given date in the future for a fixed price. This will be attractive for someone who likes speculating on asset prices and profiting from their predictions correctly made.

Kraken’s future’s platform is well equipped for advanced users and comes with a variety of charting tools and technical analysis features. While the futures and margin trading capabilities will be appealing to serious traders with a high-risk tolerance, traders who decide to use this feature should be careful as it is undoubtedly a high-risk, high reward strategy.

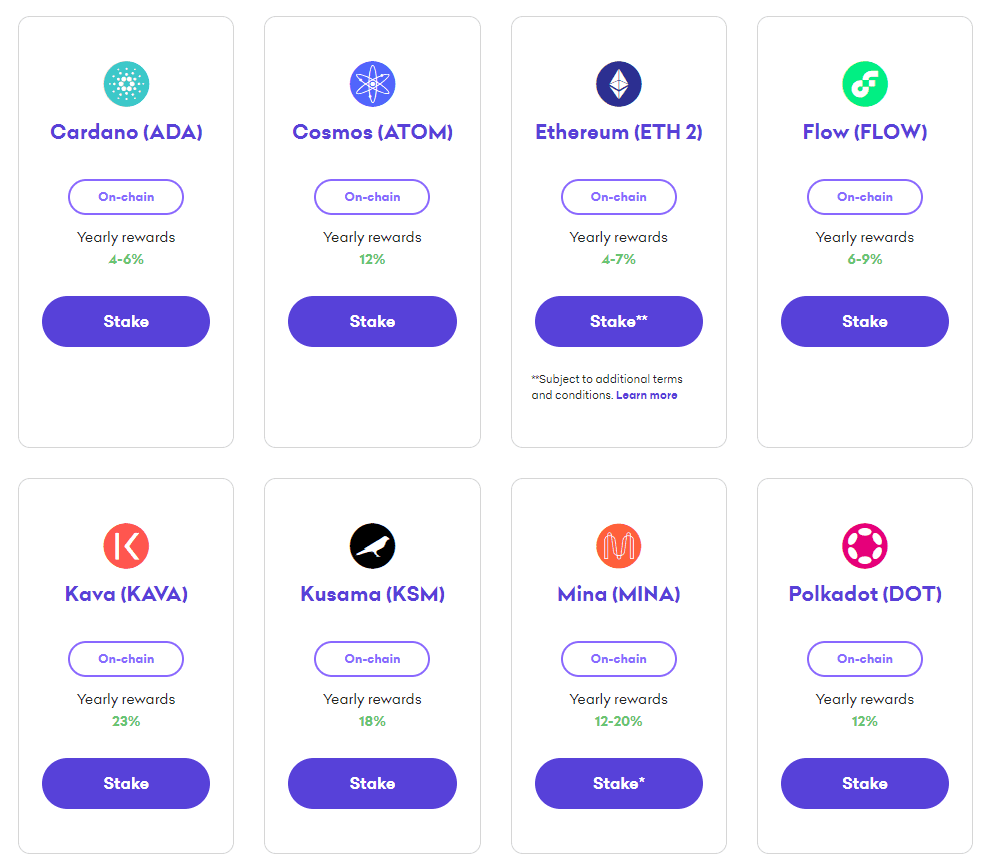

Staking

Kraken customers are able to grow their cryptocurrency and some fiat currencies via staking. Cryptocurrency staking is when an investor allocates a portion of their crypto holdings to the relevant network to assist with validating transactions. In return, the investor earns compounded rewards in the form of additional coins. Staking is an effective method for maximizing digital assets that would otherwise see little growth in an account wallet.

Kraken currently supports the staking of 10 digital assets including Bitcoin (BTC), Cardano (ADA), Solana (SOL), and Ethereum (ETH 2). The staking of fiat currencies is limited to the Euro (EUR) and US Dollar (USD).

Staking on Kraken is as easy as transferring the selected asset to a spot wallet. Staking returns for crypto ranges between 0.25% (BTC) and 20% (KAVA), whilst returns for the EUR and USD are 1.5% arangend 2%, respectively. Rewards from staking are paid out twice a week.

Cryptowatch

Cryptowatch is a unique feature that allows users to trade on multiple crypto exchanges from a single platform. Cryptowatch connects you to more than 25 other cryptocurrency platforms and acts as both an aggregator and a crypto trading bot. Cryptowatch has access to over 4,000 markets supported across the 25 crypto exchanges. There are a number of ways to you can analyze prices and set alerts so you can stay on top of market movements.

Some of the unique features offered by Cryptowatch include:

- Synchronized portfolio showing all account balances on up to 25 trading platforms

- Charting tools and indicators such as MA, MACD, RSI, and Bollinger Bands

- Advanced charting interface

- Ability to chat with other traders through the Trollbox

- Alerts and notifications for the price, volume, and TA indicators

- Streaming prices and order books from multiple crypto trading platforms

- Google Sheets integration

- Automation of trading rules through Zapier integration.

While Cryptowatch offers its basic features for free, users will need to pay if they want to get the full experience.

Kraken Pro

The Kraken Pro platform offers a range of search analysis methods including momentum trend analysis, volatility, oscillator and mean reversion tools. The charts are highly customizable meaning that traders can maximize the visibility of market prices and action.

Combined with the high liquidity in its order books, and competitive maker/taker fees, advanced investors and serious day traders will find Kraken Pro to be highly appealing. In our opinion, Kraken Pro is the best available trading platform in the market.

Premium Education Resources

Kraken understands that Blockchain and cryptocurrency are a fairly new phenomenon and have created a robust Learn Crypto section to help users learn about trading and the industry at large. Kraken offers 4 main kinds of educational resources:

- Cryptocurrency guides – Tex-based resources explaining blockchain-related topics.

- Podcast – Audio-based content on blockchain topics streamed on platforms including iTunes, Spotify, and Google Podcasts.

- Webinars – Live video recordings featuring industry players and the Kraken team seeking to inform and educate on events and topics that matter to the Kraken community.

- Videos – General video-based content submitted to YouTube for the blockchain community to consume

On top of this, there are a number of well-written articles answering the most common crypto questions as well as several crypto security issues. Kraken’s education hub is certainly one of the best out there.

SMSF Investments

Kraken supports clients who wish to invest in digital assets using their SMSF, however, a business account will need to be created and verified. Users will need to also provide details about the SMSF fund (e.g. registration date, operating address, and business registration number), a copy of the Trust agreement/deed, and proof of the SMSF operating address.

Is Kraken Regulated?

Kraken is a licensed and regulated cryptocurrency trading provider that complies with legal and regulatory requirements in all countries where it operates. The company is registered with FinCEN, FinTRAC, AUSTRAC, Financial Conduct Authority (FCA), and FSA. This means Kraken is allowed to operate as a cryptocurrency exchange in the USA, Canada, Australia, UK, and Japan.

Security Features

The Kraken platform has numerous advanced security features to protect the funds, assets, and information of its customers. Since its inception in 2011, the exchange has not reported any security breaches that have resulted in the theft, loss, or damage of held assets. This can be attributed to the security features discussed below.

Integrity Of Digital Assets & Infrastructure

Kraken stores 95% of its deposits in offline, air-gapped, geographically distributed cold storage wallets. The storage of the vast majority of assets has become a popular way of safeguarding against external attackers as the private keys would still not be accessible. All Kraken servers are situated within cages that are under 24/7 surveillance by armed guards and video monitors. Penetration testing is conducted by third parties to simulate the robustness of the implemented security measures under a wide variety of hypothetical scenarios.

Protection Of User Accounts & Information

The protection of user funds and personal information is at the forefront of Kraken’s operations. Users can activate Two Factor Authentication (2FA) to provide an additional layer of security to minimize security risks. All sensitive information is encrypted and the servers and infrastructure go through regular penetration testing to find vulnerabilities.

What About The Fees?

Deposit & Withdrawal Fees

Deposits of cryptocurrencies into the Kraken wallet will not incur a fee for the vast majority of assets including BTC, ADA, and ALGO. Crypto such as ETH will incur an on-chain fee. Kraken charges zero fees for the deposition of fiat currencies.

Withdrawals of cryptocurrencies will incur a small fee depending on the asset transferred out of the Kraken wallet.

Kraken Pro Trading Fees

The trading fees on Kraken Pro follow a maker/taker structure. This means that the fee incurred is dependent on the market order place (i.e. maker or taker order). In short, a market maker is someone who creates orders (e.g. limit order or conditional trigger) and waits for them to be filled. On the other hand, a market taker is someone who fills someone else’s orders. Market makers are the key contributors to an exchange’s order book and thus liquidity.

Kraken trading maker/taker fees begin from 0.16%/0.26% and can be reduced if the trading volume over the last 30 days meets the criteria shown below.

| 30 DAY TRADE VOLUME (USD) | MAKER FEE | TAKER FEE |

|---|---|---|

| < $50,000 | 0.16% | 0.26% |

| $50,001 – $100,000 | 0.14% | 0.24% |

| $100,001 – $250,000 | 0.12% | 0.22% |

| $250,001 – $500,000 | 0.10% | 0.20% |

| $500,001 – $1,000,000 | 0.08% | 0.18% |

| $1,000,001 – $2,500,000 | 0.06% | 0.16% |

| $2,500,001 – $5,000,000 | 0.04% | 0.14% |

| $5,000,001 – $10,000,000 | 0.02% | 0.12% |

| > $10,000,000 | 0.00% | 0.10% |

Stablecoin & Forex Fees

Kraken fees Forex trading pairs (e.g. EUR-USD) and where the stablecoin is a base currency (e.g. DAI-USDT) follow a maker/taker structure.

| 30 DAY TRADE VOLUME (USD) | MAKER FEE | TAKER FEE |

|---|---|---|

| < $50,000 | 0.2% | 0.2% |

| $50,001 – $100,000 | 0.16% | 0.16% |

| $100,001 – $250,000 | 0.12% | 0.12% |

| $250,001 – $500,000 | 0.08% | 0.08% |

| $500,001 – $1,000,000 | 0.04% | 0.04% |

| $1,000,001 – $2,500,000 | 0.00% | 0.00% |

Margin Trading Fees

Fees for opening and closing a margin position on cryptocurrencies and other digital assets range between 0.01% and 0.02%, rolling over every 4 hours. Users should note that the margin fee is applied in addition to the trading fee when a position is opened or closed.

Futures Fees

A market maker/taker fee structure applies to Kraken futures trading. Maker/taker fees start at 0.02% and 0.05%, respectively and there are volume incentives based on trading activity in the past 30 days for all cryptocurrency pairs. Traders are incentivized to engage with the market with lower trading fees to provide liquidity to the exchange by filling the order book by placing conditional and limit orders (i.e. maker fees).

| 30 DAY TRADE VOLUME (USD) | MAKER FEE | TAKER FEE |

|---|---|---|

| < $100,000 | 0.02% | 0.05% |

| $100,001 – $1,000,000 | 0.015% | 0.04% |

| $1,000,001 – $5,000,000 | 0.0125% | 0.0300% |

Accepted Countries

Kraken is a global crypto exchange that is supported in numerous countries around the world including Australia, the UK, Singapore, Canada, and China. The platform is available to investors and traders residing in the US, however, Kraken is not regulated in Washington State or New York. Persons located in New York will need to use an exchange such as Gemini that is regulated by the New York Department of Financial Services (NWSDFS).

Getting Started With Kraken

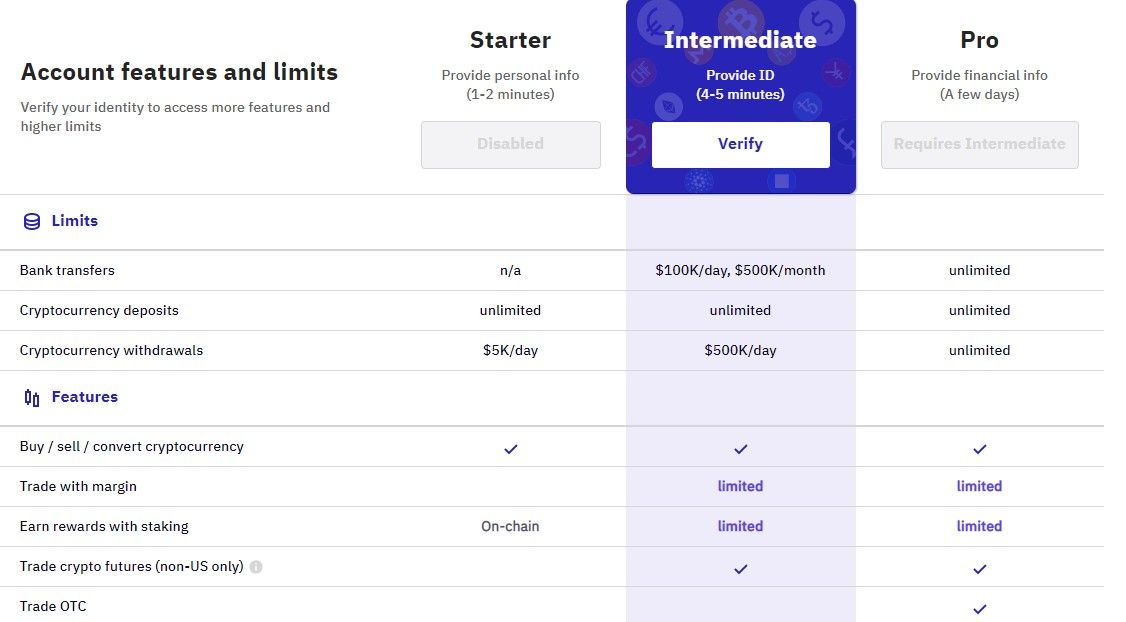

Account Creation & Verification

When starting the process to create a Kraken account, the user must choose the account type. Each type allows the users to access a different set of features and limits.

To complete account verification, users will need to provide basic personal details including ID and proof of residence (utility bill, bank statement, credit card statement, proof of residence certificate). Setting up 2FA is highly recommended to provide an additional layer of account security.

Deposit Methods & Limits

Users are able to fund their Kraken wallets with direct bank transfers, PayID/Osko, and Swift (ETANA). In terms of bank transfers, Kraken supports USD, EUR, CAD, AUD, GBP, CHF, and JPY. Users making a fiat deposit for the first time may have their funds withheld for a period of up to 72 hours. Kraken states that this is performed for security reasons. The full list of deposit limits and fees can be read on the Kraken website.

Is Kraken Easy To Use?

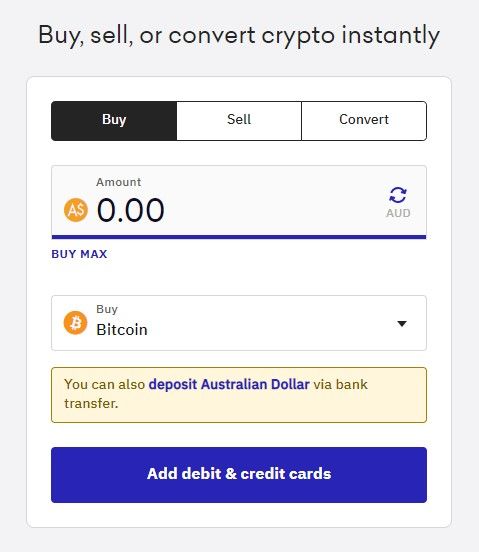

Kraken offers an incredibly simple Instant buy feature which can be accessed through the “Buy Crypto” button. The feature facilitates a quick and easy way to buy (and sell or exchange) crypto without needing to view live prices and charts.

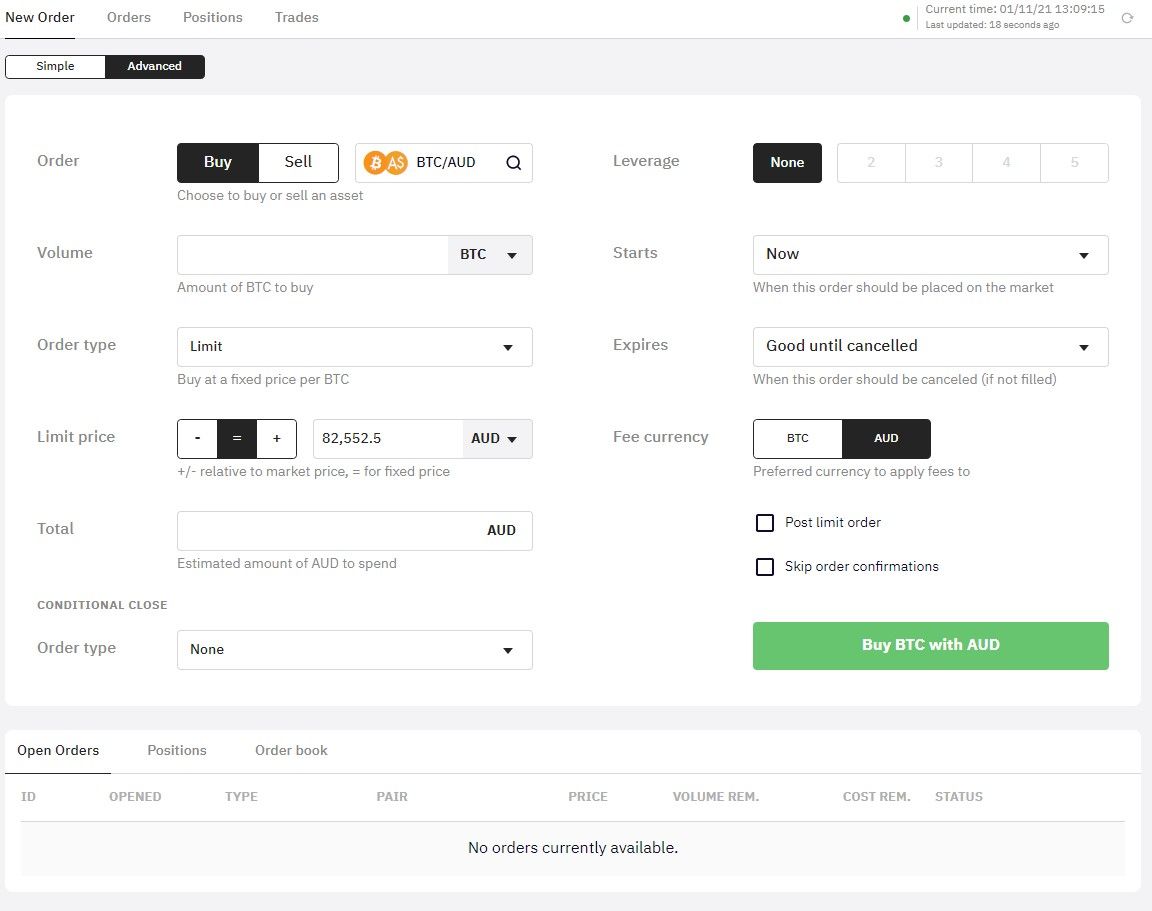

However, experienced investors will want to opt for a more advanced buying feature that includes more risk controls when placing orders on the market. In this case, the “Advanced” option can be toggled under “New Order”. Experienced investors will find the following features:

- A well-organized search tool to look for fiat-crypto and crypto-crypto trading pairs.

- Selectable order limits include Limit, Market, Stop Loss, Take Profit, Stop Loss Limit, and Take Profit Limit.

- A function to set the limit price of a purchase, either in terms of the fiat currency, or a percentage.

- Selectable expiry dates, i.e. Good Until Cancelled.

Users will note that there are no charts or order books to review. Investors and traders will need to access Kraken Pro to use advanced charting and technical analysis tools.

Customer Support & Reviews

For a large global crypto exchange, Kraken leaves nothing unturned when it comes to helpful and responsive support for its customers. Kraken users in need of troubleshooting assistance or who have queries on their products or services, can contact customer support via 24/7 live chat, phone support, or submitting a ticket to receive an email response.

Direct assistance from a member of the Kraken customer support team is available via live chat. The live chat is available 24/7 and users should be able to reach a resolution to their query in haste. This poses an advantage over other exchanges where the live chat consists of responding to a bot. Communicating with a real person is a much more amenable method of assistance.

A common method of resolving issues or answering queries for a lot of exchanges is through the submission of a ticket. Kraken is no exception and provides this service. A detailed description of the issue can be provided and a response will be returned to the email address that is associated with the user account.

A unique customer support feature that isn’t readily available amongst Kraken’s competition is the ability for users to directly call the customer support team. However, phone support is currently only available for investors residing in the US or Europe.

Kraken also offers a comprehensive selection of educational resources, helpful articles, and FAQs for those looking for a quick and specific answer to their questions. Topics are conveniently organized for ease of use.

Mobile App

Kraken offers three mobile apps, with each providing different levels of features. The Kraken mobile app is for quick buying and selling, while the Kraken Pro app is a feature-dense experience for more serious traders. Lastly, Kraken Futures app is solely focused on futures contracts. All apps are available for Android and iOS.

Kraken Alternatives

Intermediate investors and experienced traders will find the features and services offered by Kraken to be appealing. Those that do not find what they are looking for may consider the following crypto exchanges. These exchanges also have access to high liquidity and possess many features similar to Kraken.

- Binance – Binance boasts a number of services and features that will appeal to a range of crypto users, whilst still maintaining a user-friendly trading experience. Binance’s strengths lie in its high liquidity for trading pairs, low trading fees, wide range of services, and innovative features.

- Crypto.com – Crypto.com is a global crypto exchange that is well-known for its ecosystem of innovative products and services that make it a one-stop shop for crypto users. The Crypto.com app has been downloaded by over 100 million users and allows customers to buy, sell crypto, stake, earn interest, and shop using their digital currencies.

- eToro – eToro is a multi-asset social trading platform that offers cryptocurrency, stock, and CFD trading to people all over the world. With over 20 million users, eToro is a global leader in social trading.

- Bybit – Bybit is a leading cryptocurrency derivatives exchange with an emphasis on leveraged margin trading. The platform has attracted over 3 million users and offers an advanced trading interface full of high-level features.

Frequently Asked Questions

Is Kraken Suitable For Advanced Traders?

The Kraken Pro platform is a suitable choice for experienced investors and day traders. It offers a wide range of search analysis tools and customizable charting to ensure that the trading experience can be maximized.

Combined with the high liquidity in its order books, and competitive maker/taker fees, advanced investors and serious day traders will find Kraken Pro to be highly appealing.

Does Kraken Offer Insurance?

Cryptocurrency exchanges do not often qualify for deposit insurance programs because exchanges are not savings institutions. That being said, Kraken takes great care to protect the assets of their clients from loss. 95% of all deposits are kept in offline, air-gapped, geographically distributed cold storage. They have had a few minor security issues but overall they are a safe platform to trade with.

Our Verdict

Kraken has earned a reputation for its robust security framework, customer service, and regulatory compliance. Beginners with minimal crypto trading knowledge and experience might find the platform to be a bit daunting. In our opinion, Kraken would suit novice investors who possess a basic background in the world of crypto. Intermediate and experienced investors will find the advanced features in Kraken Pro to suit their trading needs.

Did You Find What You Were Looking For?

Swyftx vs Crypto.com 2023: Which Is Better For Aussies?

Updated 02 Feb, 2023

There are quite a lot of differences in the crypto service offerings of Swyftx and Crypto.com. Which platform best suits your individual crypto needs?

Best Places To Earn Crypto Interest In Australia

Updated 02 Feb, 2023

There aren't too many options for Aussie to earn interest on their crypto, however, there is one local exchange that provides great rates on popular assets.

Digital Surge Referral Code – Claim Your Free $10 BTC

Updated 02 Feb, 2023

Our Digital Surge referral link will net you $10 free of Bitcoin upon creating a new account. Click here now to avoid missing out.