BlockFi Review 2023: Is It Really Worth It?

Published 31 May, 2022 Updated 02 Feb, 2023

Table of Contents

- 1 Our Takeaways

- 2 What Is BlockFi?

- 3 BlockFi Pros & Cons

- 4 BlockFi Crypto Interest Accounts

- 5 BlockFi Crypto Loans

- 6 A Free Digital Wallet

- 7 BlockFi Credit Card

- 8 BlockFi Trading Platform

- 9 Is BlockFi Regulated?

- 10 Is BlockFi Safe To Use?

- 11 Accepted Countries

- 12 Getting Started With BlockFi

- 13 BlockFi Fees & Charges

- 14 Customer Support

- 15 Customer Reviews & Feedback

- 16 Is There A Mobile App?

- 17 Frequently Asked Questions

- 18 Our BlockFi Verdict

BlockFi is a global cryptocurrency platform that offers premium financial management services in the way of interest accounts and crypto-backed loans. The US-based and regulated platform has made its name on the back of its innovative financial services and has quickly become one of the world’s best crypto platforms to increase yields on crypto holdings.

As always, it’s important to be informed before you commit to any crypto exchange or platform. Here is what you need to know about BlockFi.

UPDATE: BlockFi has entered into administration and is not available to use.

Promotion: None available at this time

Trading Fees: None

Available Cryptos: 20+

We work with partners that may result in MoreCrypto earning a small commission. Read our affiliate disclaimer for further information.

Our Takeaways

Apart from the limited number of supported crypto and high withdrawal fees for stablecoins, BlockFi impressed us with its interest-earning accounts where you can up to 11% APY and crypto-backed loans that let you get the most out of your digital assets.

Overall, BlockFi is a great option if you want to earn interest on your idle crypto holdings or use it to free up some cash by taking out a loan. However, if you want the option of buying, trading, or selling a wider range of altcoins then you will need to find an alternative exchange.

| Name | BlockFi |

|---|---|

| Core Services | Interest accounts and loans |

| Available Cryptocurrencies | Interest-earning (19), loan collateral (4) |

| Fiat Currencies | USD, EUR |

| Deposit Options | Wire transfer (USA), SWIFT (global), crypto transfer |

| Deposit Fees | None |

| Interest | Up to 11% APY |

| Withdrawal Fees | Limited free withdrawals, $50 for stablecoins |

| Mobile App | Yes (iOS and Android) |

What Is BlockFi?

BlockFi is a cryptocurrency management platform that provides premium financial services to individual investors and corporate institutions around the globe. Established in 2017 and headquartered in Jersey City, New Jersey, BlockFi, operating under BlockFi Lending LCC, offers a range of innovative lending and borrowing products which are regulated under US state and Federal law.

BlockFi’s Decentralized Finance (DeFi) products and services translate into several advantages for investors who want to leverage their digital assets without the traditional financial system. Its key features include interest-earning accounts, crypto-backed loans, and a credit card that offers crypto rewards when you spend.

BlockFi is one of the more well-known crypto lending and borrowing exchanges in the world. The exchange has attracted over 1 million customers and 350 global institutions. BlockFi manages over $10 billion worth of digital assets and has returned over $700 million worth of crypto interest and rewards to its userbase.

BlockFi Pros & Cons

Pros

- Use your crypto to take out a cash loan.

- No minimum deposit to get started.

- Earn up to 11% APY on your crypto holdings.

- Regulated by state and Federal US laws to provide crypto financial services.

- Excellent customer service including direct phone support.

Cons

- Limited number of supported cryptocurrencies.

- Hefty fee of USD $50 to withdraw stablecoins from your wallet.

- Interest-earning accounts are not available to New York residents.

- Limited free withdrawals.

BlockFi Crypto Interest Accounts

What Is The BlockFi Interest Account?

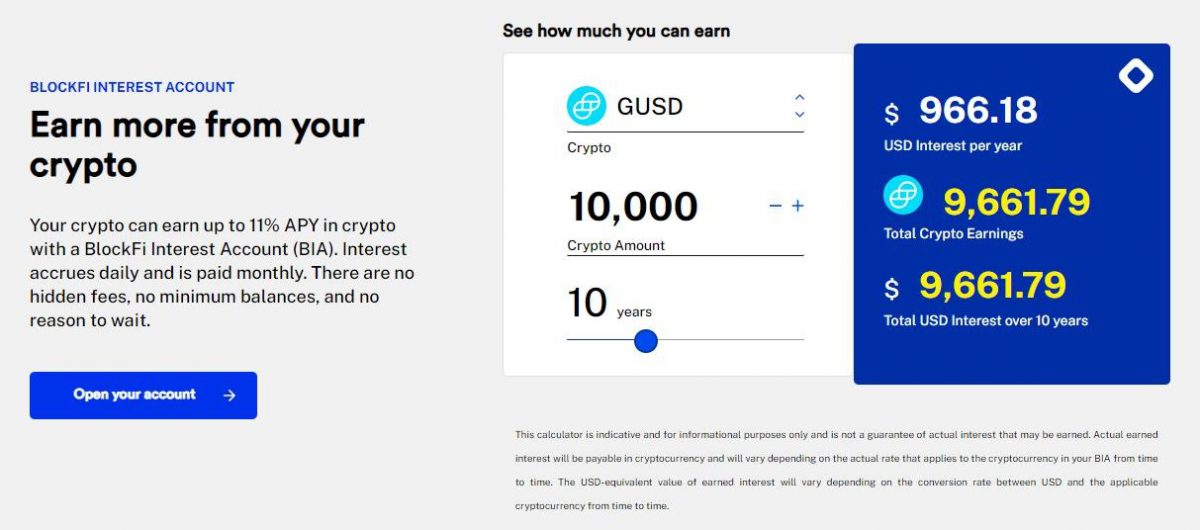

The BlockFi Interest Account (BIA) allows you to earn interest yields on cryptocurrencies such as Bitcoin and Ethereum that you store with BlockFi. The platform lends the digital asset funds to trusted institutional and corporate borrowers and receives interest on the stored assets.

If you store your cryptocurrencies within your BIA, then they are designated for interest-earning purposes. If you wish to withdraw your assets or use them as loan collateral, then you will need to transfer the assets from the BIA and into the BlockFi wallet. Transfers of crypto in and out of your BIA account are immediate and free.

Minimum Deposit Amounts

You don’t need to have a certain amount of crypto in your BIA for interest to start accruing as BlockFi does not set minimum (or maximum) deposit amounts. This is quite attractive for beginner investors who want their Bitcoin or Ethereum to work for them as large amounts are not needed to start.

What Are The Interest Rates?

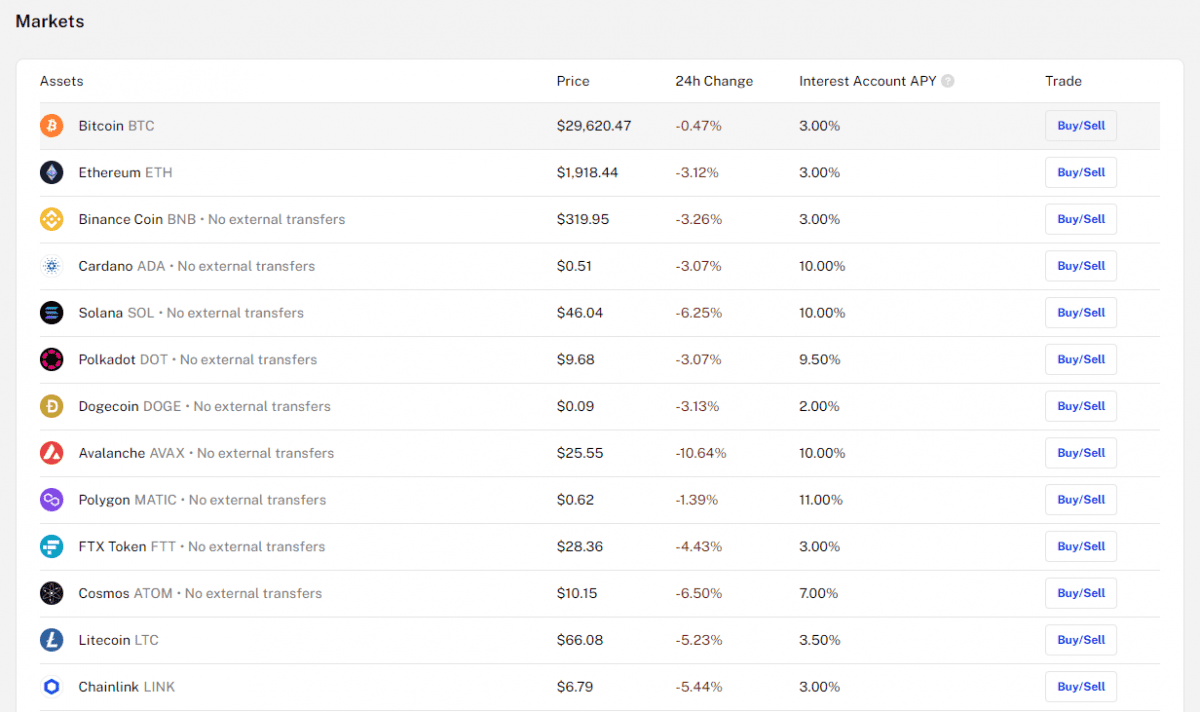

BlockFi offers very competitive interest rates that range between 1% and 11% Annual Percentage Yield (APY) on 19 cryptocurrencies including Bitcoin, stablecoins, and altcoins.

It should be noted that the interest rates for selected crypto follow a tiered system where the interest rate is dependent on the amount deposited. This applies to cryptos such as BTC, ETH, LINK, and LTC. Whereas other digital assets such as ALGO, BCH, and ATOM will earn a flat interest rate.

For example, tiered interest rates for Bitcoin are as follows.

| TIER | AMOUNT DEPOSITED | APY |

|---|---|---|

| Tier 1 | 0 – 0.1 BTC | 3% |

| Tier 2 | 0.1 – 0.35 BTC | 1% |

| Tier 3 | > 0.35 BTC | 0.1% |

At the time of writing, BlockFi’s interest rates for their supported cryptocurrencies are shown in the table below. The interest rate that BlockFi can offer depends on what rate institutions are willing to pay to borrow BlockFi’s digital assets. If a change in these market conditions is realized, your APY may also change.

| TIERED APY | FLAT APY |

|---|---|

| BTC – 3%, 1%, 0.1% | DOT – 9.5% |

| ETH – 3%, 1.5%, 0.25% | ATOM – 7% |

| USDT – 7.25%, 6%, 4.5% | BCH- 3% |

| GUSD – 7%, 5%, 4% | DOGE – 2% |

| BAT – 1%, 0.2%, 0.1% | ALGO – 2.5% |

| ETH – 3%, 1.5%, 0.25% | ADA – 10% |

| LTC – 3.5%, 1%, 0.1% | AVAX – 10% |

| UNI – 3.25%, 0.2%, 0.1% | FIL – 2% |

| DAI – 7%, 5%, 4% | MATIC – 11% |

| BUSD – 7%, 5%, 4% | SOL – 10% |

| LINK – 3%, 0.5%, 0.1% | |

| PAXG – 3.25%, 0.2%, 0.1% |

How Often Is Interest Paid Out?

Interest starts to accrue daily after your BIA is funded with a platform-supported cryptocurrency. Interest payments are paid out on the last business day of each month. Interest is paid out with the initial crypto deposit which means that the interest yields compound over time.

Flexible Interest Pay Outs

A unique feature that BlockFi offers is the Crypto Interest Payment Flex which provides you with the option of interest being paid out in the cryptocurrency of your choice. For example, if you are earning monthly interest payments on Bitcoin, then you can choose for the interest to be paid out in Ethereum.

This feature gets particularly useful if you are earning interest on multiple digital assets. For example, if you currently store Bitcoin, Ethereum, and Cardano, then you can choose to have all interest paid out in Bitcoin.

BlockFi’s Crypto Interest Payment Flex feature is an example of the platform’s sound asset management tools. Instead of buying additional crypto to diversify your portfolio, you can just toggle the interest payment options to suit your needs.

Does BIA Interest Compound?

Yes, the interest you earn in your BIA compounds every month. This means that you will receive higher interest yields with time.

For example, the interest payment for the second month will be calculated based on the total balance of the first month (old balance plus interest payment).

Who Is Eligible For A BlockFi Interest Account?

Before 15 February 2022, US citizens could create a BlockFi interest account however this changed in mid-February 2022. Due to regulatory reasons, only non-US users are eligible for a BlockFi interest account.

US investors who historically created a BlockFi interest account can maintain their balances and continue to earn interest, however, additional crypto is not allowed to be deposited.

If you’re located in Australia, then BlockFi is one of the better platforms to earn interest on cryptocurrencies.

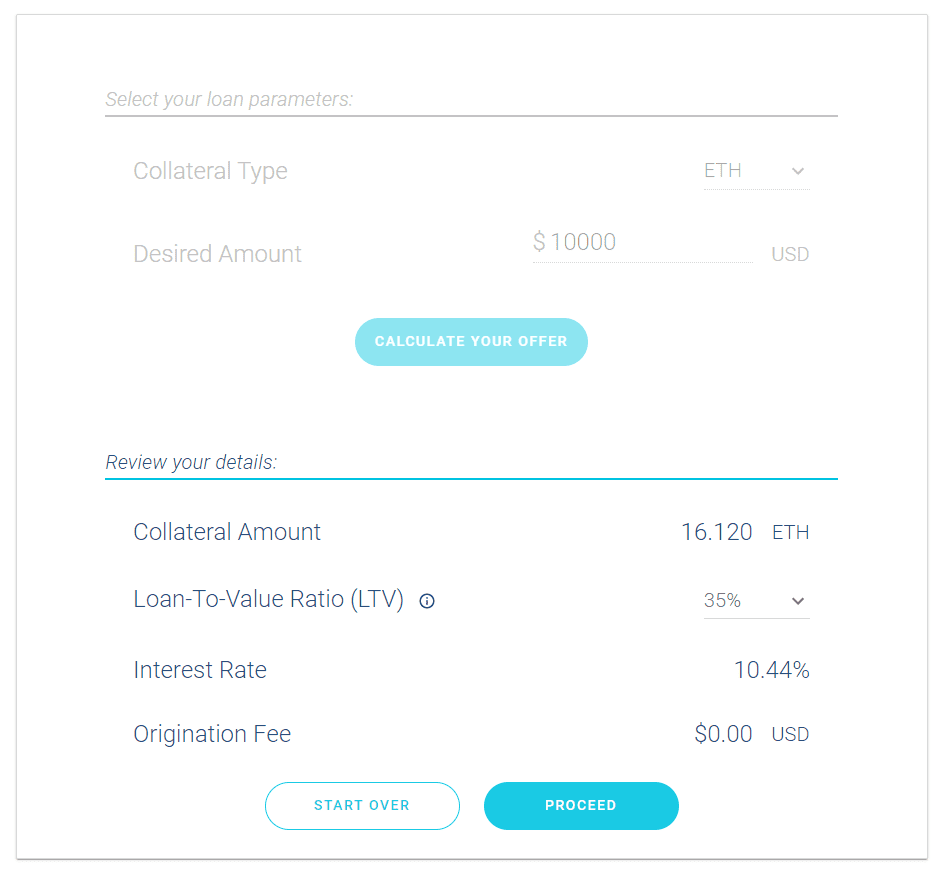

BlockFi Crypto Loans

Taking out a crypto-backed loan has its advantages. You don’t need to sell your digital assets (which will likely trigger a taxable event) to unlock capital. This means that you can leverage your crypto assets and have them continue to appreciate over the long term.

BlockFi is well-known for its crypto loans that are popular amongst savvy investors. Compared to traditional lenders such as financial institutions, taking out a loan with BlockFi is much faster and they don’t need any credit information. All you need is collateral.

How Do BlockFi Loans Work?

You can only take out a BlockFi loan if you have at least $10,000 worth of the supported collateral assets. Once you deposit your chosen collateral, you can borrow United States Dollars (USD). The amount of USD that you borrow depends on the amount of collateral as well as the LTV you select (up to 50% LTV). Loans terms are set as 12 months and you will incur a 2% origination fee once the loan is paid back in full, inclusive of the interest accumulated.

What Can Be Used As Collateral?

BlockFi allows you to use BTC, ETH, LTC, and PAXG as collateral to receive USD direct into your bank account. Loaned assets are not limited to USD and you can choose to receive Gemini Dollars (GUSD), USD Coin (USDC), or Paxos (PAX). If you want to increase the loaned amount then you can add more collateral down the track.

Crypto-Backed Loan Rates

BlockFi interest rates for crypto-backed loans range between 4.5% and 9.75%, which excludes the flat 2% origination fee. The amount of USD that you can borrow from BlockFi depends on the collateral amount as well as the Loan-to-Value (LTV) ratio. The LTV is determined by dividing the loan amount by the collateral value. If the LTV is 50% then the interest rate will be 9.75%.

| LTV | INTEREST RATE | ORIGINATION FEE |

|---|---|---|

| 50% | 9.75% | 2% |

| 35% | 7.9% | 2% |

| 20% | 4.5% | 2% |

A Free Digital Wallet

BlockFi provides you with a free and secure digital wallet to store your digital currencies. The best part is that you can easily transfer assets between your BlockFi Earn and Loan wallets. Key features and benefits include:

- The default wallet for crypto that is bought, traded, or sold on BlockFi.

- No fees and no minimum balance are required to get started.

- Manage your crypto assets by moving them between interest-earning and loan accounts.

- Peace of mind with high-security measures including whitelisting and 2FA.

- Access to tax reporting tools that will make end-of-year financial obligations easier. Available to US customers only.

Online wallets such as these are usually just standard hot-wallet storage solutions that allow you to store your digital assets without the need for an external hardware wallet. They are typically marketed by exchanges as ‘special’ wallets with additional features to make them more palatable. However, the key advantage, including BlockFi, is the added functionality that they bring to asset management.

BlockFi Credit Card

If you have created a BlockFi account then you can also apply for the BlockFi Credit Card returns rewards of 3.5% in crypto for purchases made during the first 3 months (up to a spend of $3,500). Additionally, 2% is rewarded back in crypto for every purchase made over $50,000 of your annual spend.

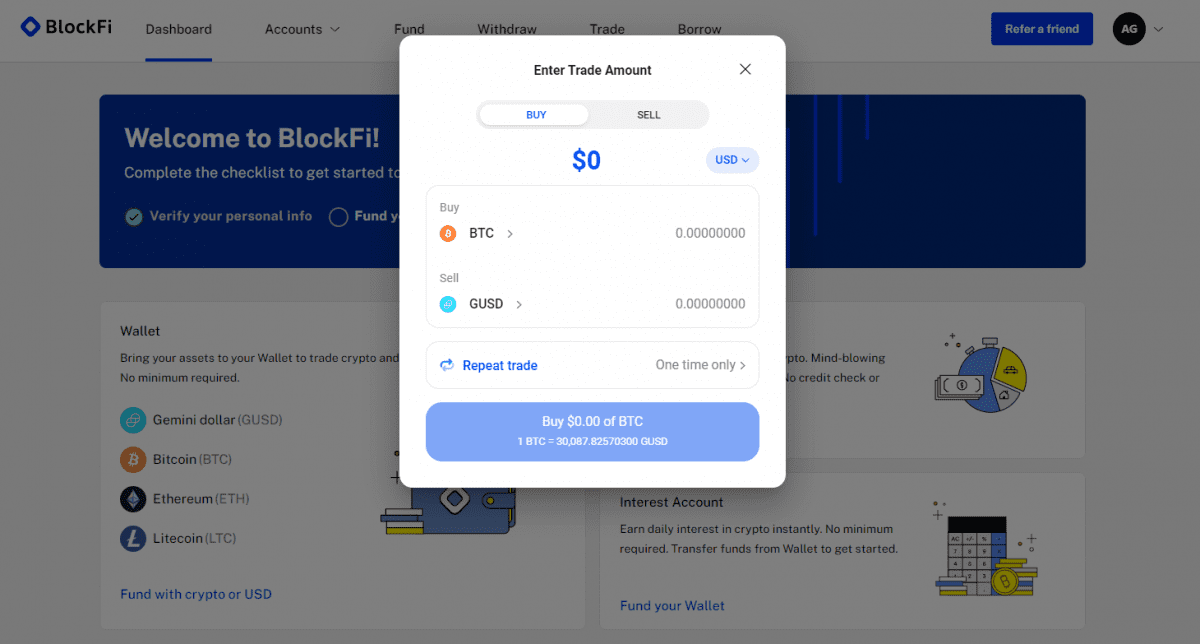

BlockFi Trading Platform

BlockFi is much more than a crypto platform that offers financial services. It also has its own trading interface where you can buy and sell Bitcoin and other cryptocurrencies and stablecoins.

When you send USD to BlockFi to buy crypto, it’s actually converted to the same amount but as a USD-pegged stablecoin such as GUSD. So, rather than using USD to buy crypto, it is the stablecoin that is exchanged. This is why you might notice that the trading pairs to buy digital currencies have a stablecoin as the selling asset.

You have the option to purchase over 30+ cryptocurrencies including Bitcoin, stablecoins, and various altcoins such as Chainlink (LINK), Algorand (ALGO), and Fantom (FTM). You can also set the frequency of buys to one-time, daily, weekly, fortnightly, or monthly.

Digital assets that you buy can either be transferred to an external hardware wallet or the BlockFi wallet. The BlockFi wallet is the default location where your crypto will be stored. The best part is that you easily allocate assets from the wallet and into an interest-earning wallet or as collateral for a loan.

Is BlockFi Regulated?

BlockFi is a legitimate wealth management company that offers a range of DeFi products and services. The exchange adheres to strict regulatory requirements by 48 states within the USA. However, due to regulatory reasons, some services such as the BlockFi Interest Account are not offered to US residents. BlockFi’s digital asset custodian is licensed by the New York Department of Financial Services (NYWFS).

Is BlockFi Safe To Use?

BlockFi is a top performer when it comes to security and the safety of your assets. All of your crypto assets will be stored in offline vaults that are managed by Gemini. Gemini is a New York-based crypto exchange is a licensed depository trust and was one of the world’s first exchanges to obtain SOC 1 Type 2 exam, SOC 2 Type 2 exam, and ISO 27001 certification.

Assets held in secure offline vaults are protected by multilayer encryption techniques possessing a FIPS 140-2 Level 3 rating, multi-signature protocols, private hardware keys, and partnerships with security vendors to mitigate against external attacks.

At the account level, you have the option of setting up biometric login on the iOS and Android compatible mobile apps, 2FA, and whitelisting wallet addresses.

Accepted Countries

BlockFi’s crypto lending and borrowing services are available to investors located in countries all over the world including the United States of America (USA), Australia, Japan, Canada, the United Kingdom (UK), and Singapore. Currently, BlockFi is not available in sanctioned and watch-listed countries.

Getting Started With BlockFi

Creating An Account

We were impressed by BlockFi’s account creation process which was refreshingly quick and streamlined. We created an account and verified our identity in less than 5 minutes.

To create a BlockFi account, you will need a valid email address and a strong password. Due to regulatory reasons, verifying your identity is a mandatory step for crypto exchanges to complete. After you submit a copy of your driver’s license or passport, your mobile device can be used for facial recognition.

Account Funding Methods

BlockFi allows you to deposit United States Dollars (USD) or Euros (EUR) into your account via wire transfers or SWIFT. Currently, USD deposits via wire or bank transfers (ACH) are not available in all US states, so you might notice that these options are not presented to you.

You won’t see any deposited USD or EUR in your account. Once you transfer USD or EUR funds, BlockFi will give you the option to purchase any crypto asset or stablecoin that is supported by the platform. The default stablecoin that will be credited is the Gemini Dollar (GUSD).

| COUNTRY | METHOD | DURATION | MINIMUM | FEE |

|---|---|---|---|---|

| USA | Wire transfer | 1 -2 business days | $10 | None |

| Non-USA | SWIFT | 3 – 5 business days | $10 | None |

Alternatively, you can fund your BlockFi account by transferring your crypto from an external wallet. Currently, BlockFi accounts can be funded with 13 cryptocurrencies, including:

- Bitcoin

- Ethereum

- Litecoin

- Chainlink

- Uniswap

- Basic Attention Token

- Tether

- USD Coin

- Binance USD

- Dai

- PAX Gold

- Gemini USD

- Paxos

BlockFi Fees & Charges

Deposit & Withdrawal Fees

Deposits of cryptocurrencies into your BlockFi can be done free of charge, however, there are things you need to know for withdrawals.

BlockFi allows you to withdraw selected crypto such as BTC and LTC from your wallet for free on a monthly basis with limits on the amount that you can withdraw set weekly. Fees for BTC and LTC withdrawals are 0.00075 BTC and 0.001 LTC, respectively. If you decide to withdraw stablecoins then you will incur a hefty fee of $50 USD.

Free withdrawals are not supported for ETH, LINK, PAXG, UNI, and BAT, where the fee varies depending on the coin.

| CRYPTO | WITHDRAWAL LIMIT (7 DAY PERIOD) | WITHDRAWAL FEE |

|---|---|---|

| BTC | 100 BTC | 0.00075 BTC |

| LTC | 10,000 LTC | 0.001 LTC |

| GUSD, USDC, BUSD, PAX, DAI, USDT | 1,000,000 | 50 USD |

| ETH | 5,000 ETH | 0.015 ETH |

| LINK | 65,000 LINK | 2 LINK |

| PAXG | 500 PAXG | 0.035 PAXG |

| UNI | 5,500 UNI | 2.5 UNI |

| BAT | 2,000,000 BAT | 60 BAT |

BlockFi Credit Card Fees

BlockFi credit fees are quite reasonable compared to other crypto credit card providers. You won’t see any annual fees, foreign transaction fees, or a fee for going over your limit. If you’re late with a repayment (within 10 days of the due date) then the fee will be $25. Return payment fees are $37.

Customer Support

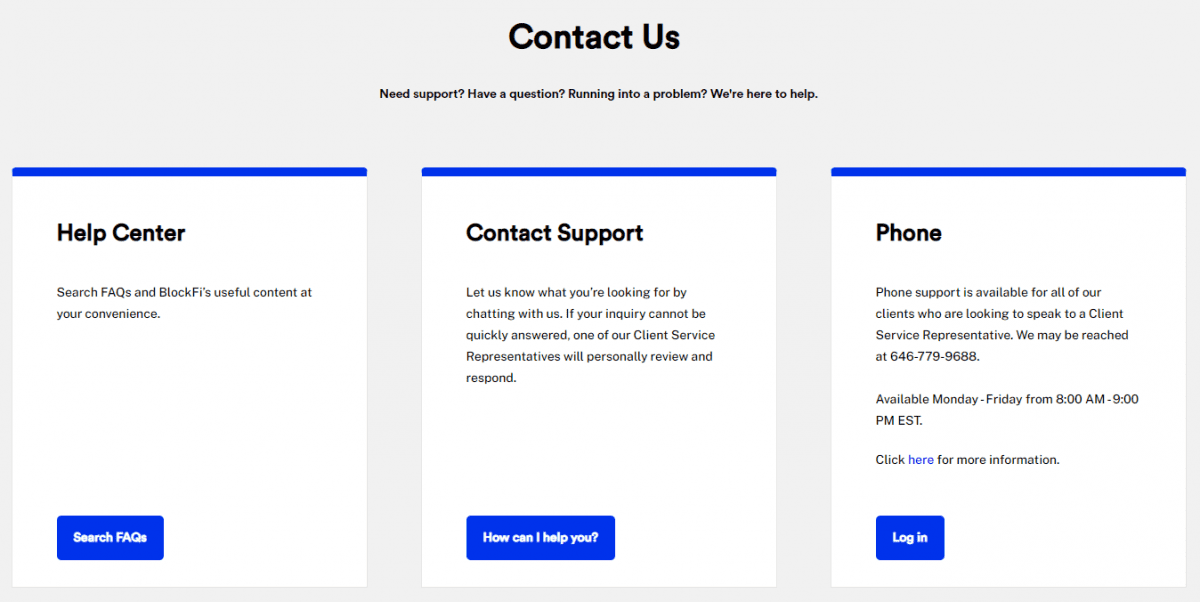

BlockFi offers a comprehensive library of well-written Frequently Asked Questions (FAQs) to assist you in understanding the nuances of their products and services. The articles provided are specific, relevant for each feature, and written in a concise fashion to make it easy for new starters to digest and beginners using BlockFi will be able to get a firm grounding.

BlockFi is one of the more approachable crypto lending and borrowing platforms with excellent avenues for you to contact the customer support team. If you’re having issues or have queries then you contact BlockFi via the 24/7 live chat, phone, submitting a ticket, or even physical mail. Based on our experience, a Client Services Representative will likely respond to your query in less than 24 hours.

BlockFi is active on its social media platforms including Twitter, Facebook, and Telegram.

Overall, it is clear that BlockFi places an emphasis on allowing customers to access assistance for an enjoyable experience. The platform offers more ways for you to get in touch with its dedicated team than most other platforms.

Customer Reviews & Feedback

Based on a small sample size of over 250 customer reviews on TrustPilot, BlockFi has a mediocre rating of 3.5/5.0, with 70% of reviews categorized as “great” or “excellent”. From a review of the comments, it appears that BlockFi has a mixed reputation where customers applauded the crypto features, but many people were irritated by the long wait for withdrawals of assets to occur.

Whilst the majority of BlockFi clients appear to be happy with the service, the number and nature of negative feedback raise a few questions regarding how the platform is perceived in the community. We noted that BlockFi responded to almost all customer reviews including ones providing negative commentary which is a good indication of the platform’s commitment to addressing customer issues.

Is There A Mobile App?

BlockFi offers apps for iOS and Android mobile devices that lets you access and manage your cryptocurrency portfolio on the go. Features that are accessible on the app include account funding via wire transfer of USD or crypto transfer, applying for loans, and interest accounts.

In terms of its design, the app feels a bit basic and barebones and is not as polished as other mobile apps in the crypto lending and borrowing space. However, it also doesn’t need to be. From our testing, the app was highly responsive and easy to understand since all the features are accessed from the main page. For added peace of mind, you also have the option of setting up biometric login to protect your account from unauthorized access.

The BlockFi mobile app for Android devices has been downloaded over 500,000 times and has an overall rating of 3.7/5.0. Similar to the customer reviews on TrustPilot, we noted that BlockFi made an effort to respond to positive and negative feedback on the app, which demonstrates a willingness to provide excellent support for its users.

Frequently Asked Questions

Is BlockFi TrustWorthy?

BlockFi is a legitimate and trustworthy cryptocurrency platform that offers financial services to investors worldwide. In the USA, its products and services are regulated by state and federal laws set out by the SEC. Its digital asset storage custodian, Gemini Trust company, is regulated by the New York Department of Financial Services. BlockFi is trusted by over 1 million customers and over 350 global institutions and companies. The platform currently manages over $10 billion worth of digital assets.

Is BlockFi Interest Paid Daily?

Cryptocurrencies such as Bitcoin and Ethereum that you place into a BlockFi Interest Account can earn between 1% and 11% Annual Percentage Yield (APY). Interest accumulates daily and is paid out monthly. Interest is paid out with the initial deposit which means that interest compounds over time.

Can You Lose Money On BlockFi?

BlockFi’s accounts are not insured by the SIPC or the FDIC. This means that you could be at risk of losing your fiat funds and digital assets in the event the company goes out of business. However, security is first-class. All assets are secured by Gemini, a New York licensed exchange that possesses SOC 1/2 Type 2, and ISO 27001 certification.

Our BlockFi Verdict

BlockFi is a premium lending and borrowing service that allows you to take control and get the best of your crypto holdings. The US-based and regulated platform has enough features and supported digital currencies to get the majority of beginner investors going. It is also clear that BlockFi has placed an emphasis on customer support and satisfaction by providing several avenues to help and responding to feedback on popular review sites.

BlockFi will be a sound first choice for beginners looking to leverage their crypto assets by earning interest or borrowing USD against their holdings.

Did You Find What You Were Looking For?

Swyftx vs Crypto.com 2023: Which Is Better For Aussies?

Updated 02 Feb, 2023

There are quite a lot of differences in the crypto service offerings of Swyftx and Crypto.com. Which platform best suits your individual crypto needs?

Best Places To Earn Crypto Interest In Australia

Updated 02 Feb, 2023

There aren't too many options for Aussie to earn interest on their crypto, however, there is one local exchange that provides great rates on popular assets.

Digital Surge Referral Code – Claim Your Free $10 BTC

Updated 02 Feb, 2023

Our Digital Surge referral link will net you $10 free of Bitcoin upon creating a new account. Click here now to avoid missing out.