- Interest rates for stablecoins are not as attractive as other staking platforms.

Where To Stake Crypto In Australia For 2023

Published 25 Jun, 2022 Updated 02 Feb, 2023

Table of Contents

Crypto staking, mining, and earning interest are similar in that they all generate crypto in one way or another. In Australia, staking crypto is a popular way of leveraging idle digital assets to generate a passive income over time.

Some of the best cryptocurrency exchanges in Australia provide staking services for digital assets that support the Proof-of-Staking (PoS) consensus protocol. In this guide, we cover which crypto platforms offer a wide selection of crypto to stake, low fees, and payout frequencies.

Best Places To Stake Crypto In Australia

Australian investors have fantastic options for staking their cryptocurrencies. Based on our reviews, the best places for Aussies to stake their crypto and earn rewards are highly reputable global exchanges, as listed below.

- Binance (best overall staking option for Australians)

- Crypto.com (best for active traders)

- Kraken (best for ETH 2.0 staking)

- eToro (an alternative option)

Comparing The Top Australian Staking Platforms

| Exchange | Assets | Trading Fees | Our Ratings | Learn More | Promotion |

|---|---|---|---|---|---|

|

|

600+ | 0.1% (maker) and 0.1% (taker) | 3.7/5 | Visit Binance Australia Binance Australia Review | None available at this time |

|

|

250+ | 0.4% (maker) and 0.4% (taker) | 4.3/5 | Visit Crypto.com Crypto.com Review | None available at this time |

Kraken

Kraken

|

102 | 0.16% (maker) and 0.26% (taker) | 4.3/5 | Visit Kraken Kraken Review | None available at this time |

eToro

eToro

|

25 | 1% | 4.0/5 | Visit eToro eToro Review | None available at this time |

Where To Stake Crypto Australia: 2023 Reviews

1. Binance Australia

BEST OVERALL STAKING OPTION FOR AUSTRALIANS

Binance is a premium crypto exchange that provides you with an exceptional suite of cutting-edge products and services. This includes staking which is available through the Binance Earn module. With 112 digital currencies that can be staked to unlock earning rewards, Binance Australia possesses the widest selection of staking options.

| Name | Binance Australia |

|---|---|

| Supported Crypto | 112 |

| Stablecoin APY % | Up to 13.3% |

| Non-Stablecoin APY % | Up to 79% |

| Interest Pay Out | Daily |

| Fees | None |

| Terms | Flexible, 21, 30, 60 and 90 days |

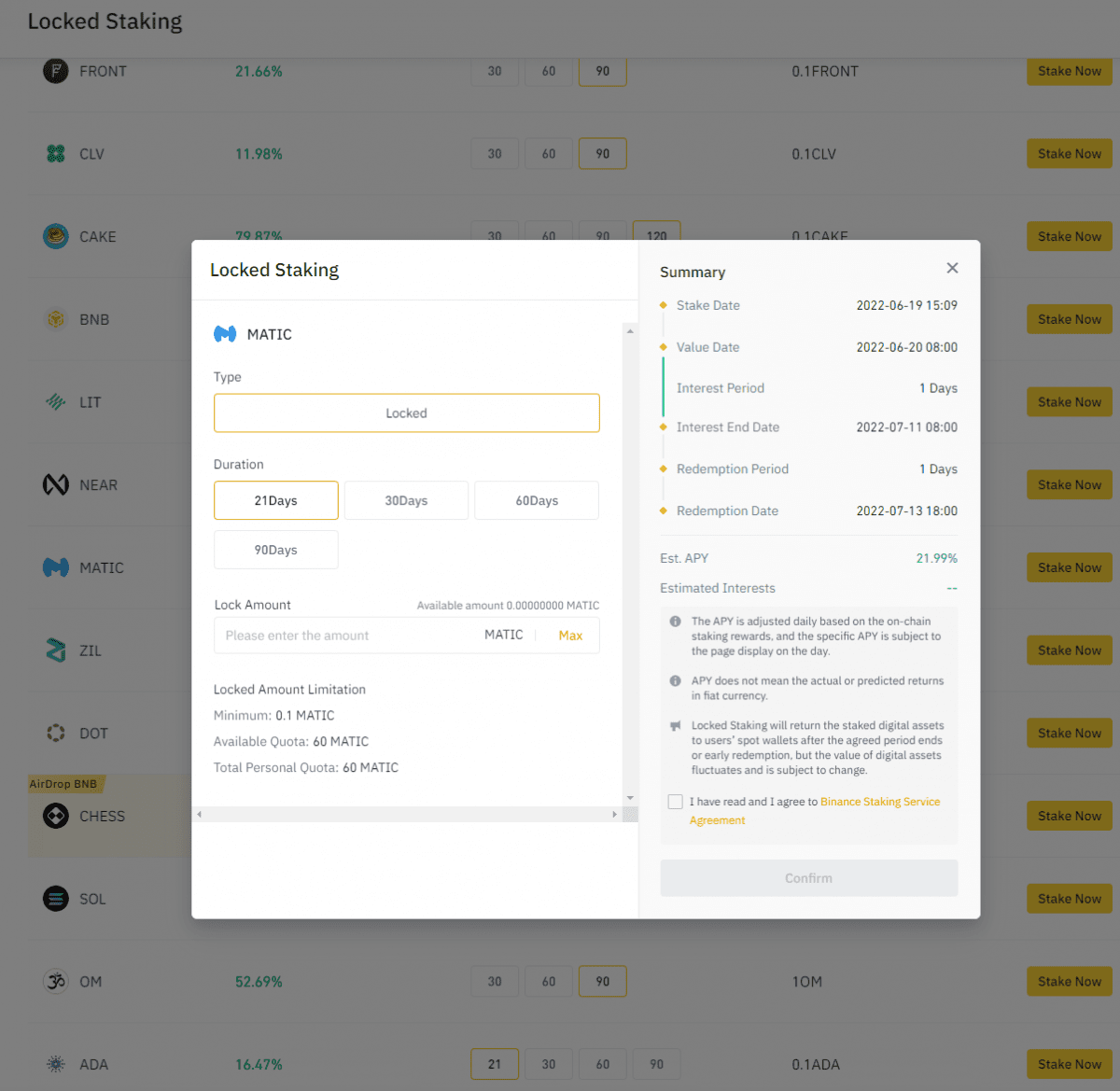

Staking cryptocurrencies is offered on Binance Earn through two modules, Locked Staking, and DeFi staking. The vast majority of digital assets can only be staked under fixed terms of up to 120 days, however, you do get some choice with 30, 60, and 90-day terms available for selected crypto. This will be an important factor to consider given that assets are locked for the term. They can still be withdrawn however you won’t receive any interest over the staking period.

Popular altcoins that can be staked include AVAX, TRON, DOT, ADA, CAKE, MATIC, and many more. With locked staking yields ranging from 7% APY to 79% APY, depositing idle cryptocurrencies into a Lock Staking term is a great for way for beginners to earn a passive income using a ‘set and forget’ method.

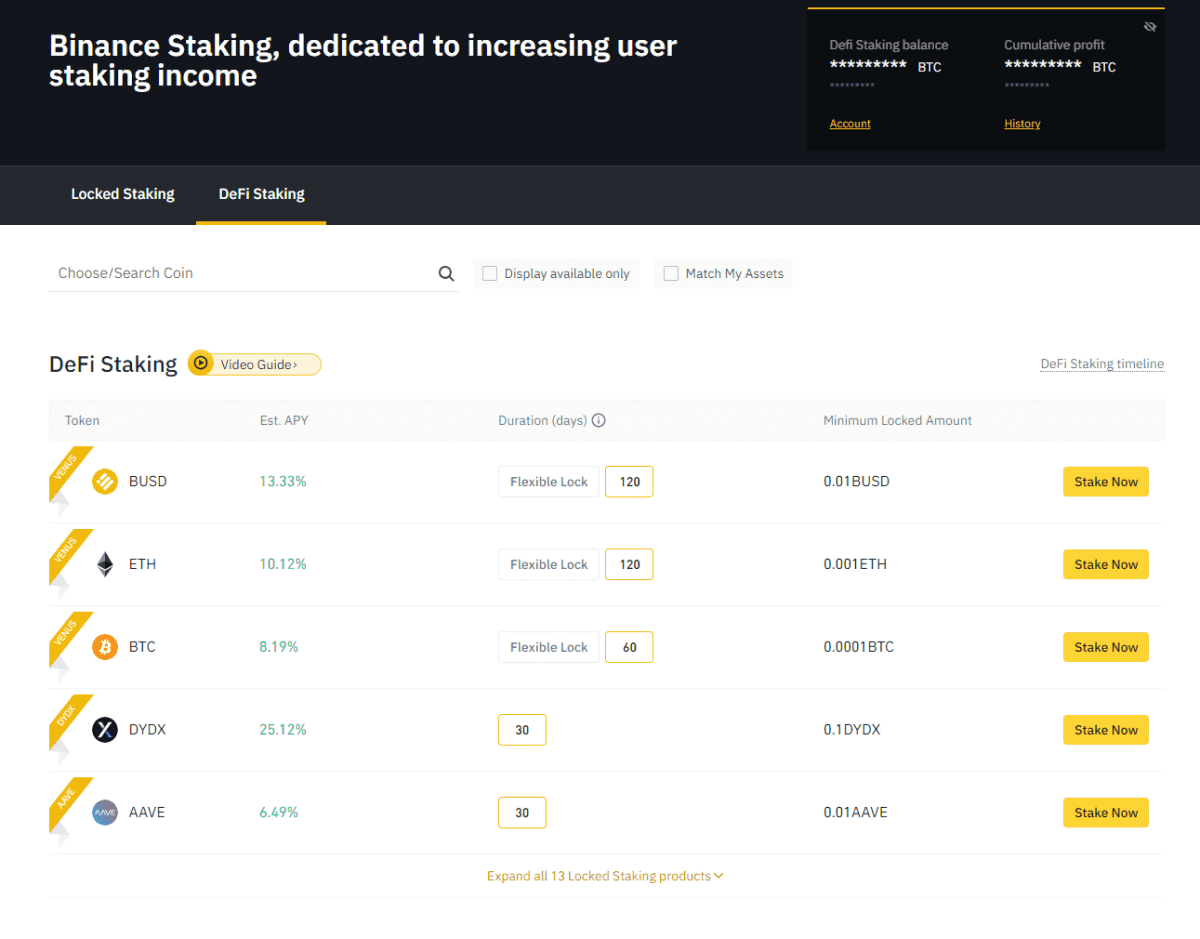

Compared to Locked Staking, the DeFi module lets you stake Bitcoin and other popular assets over flexible terms. The APY% yields are comparatively lower, however, you have the convenience of withdrawing your staked assets at any time.

At the time of writing, estimated interest rates for popular DeFi projects include:

- Bitcoin – 8.19% (flexible or 60 days)

- Ethereum – 10.12% (flexible or 120 days)

- USDT – 3.12% (flexible)

- BUSB – 13.33% (flexible or 120 days)

- AAVE – 6.49% (30 days)

The process of staking your crypto on Binance is easy and intuitive. As seen in the image below, clicking on ‘Stake Now’ will present a panel with the details to review. Once you set the term, the amount of crypto to stake, and the APY%, confirming the arrangement will automatically transfer the assets from your wallet and into your Binance Earn wallet where they will remain over the staking period.

Interest is paid out to your wallet on a daily basis. With no staking fees to worry about, the barriers to entry with Binance are low. One of the advantages of using Binance to stake your coins is that you also have access to the wide crypto service offerings on the exchange.

Binance Australia Staking Pros

Pros

- Binance offers the widest selection of crypto that can be staked to Australians.

- Opt for flexible or locked terms (21, 30, 60 or 90 days).

- No staking fees apply.

- An easy staking process that can be completed in a few clicks.

Cons

2. Crypto.com Exchange

BEST FOR ACTIVE TRADERS

Crypto.com is a global digital currency exchange that offers a range of products and services through a world-class mobile app. The platform boasts an impressive customer base of over 10 million users worldwide across 90 countries including Australia. Soft Staking is the exchange’s module where you can passively grow your crypto portfolio by earning interest on idle assets.

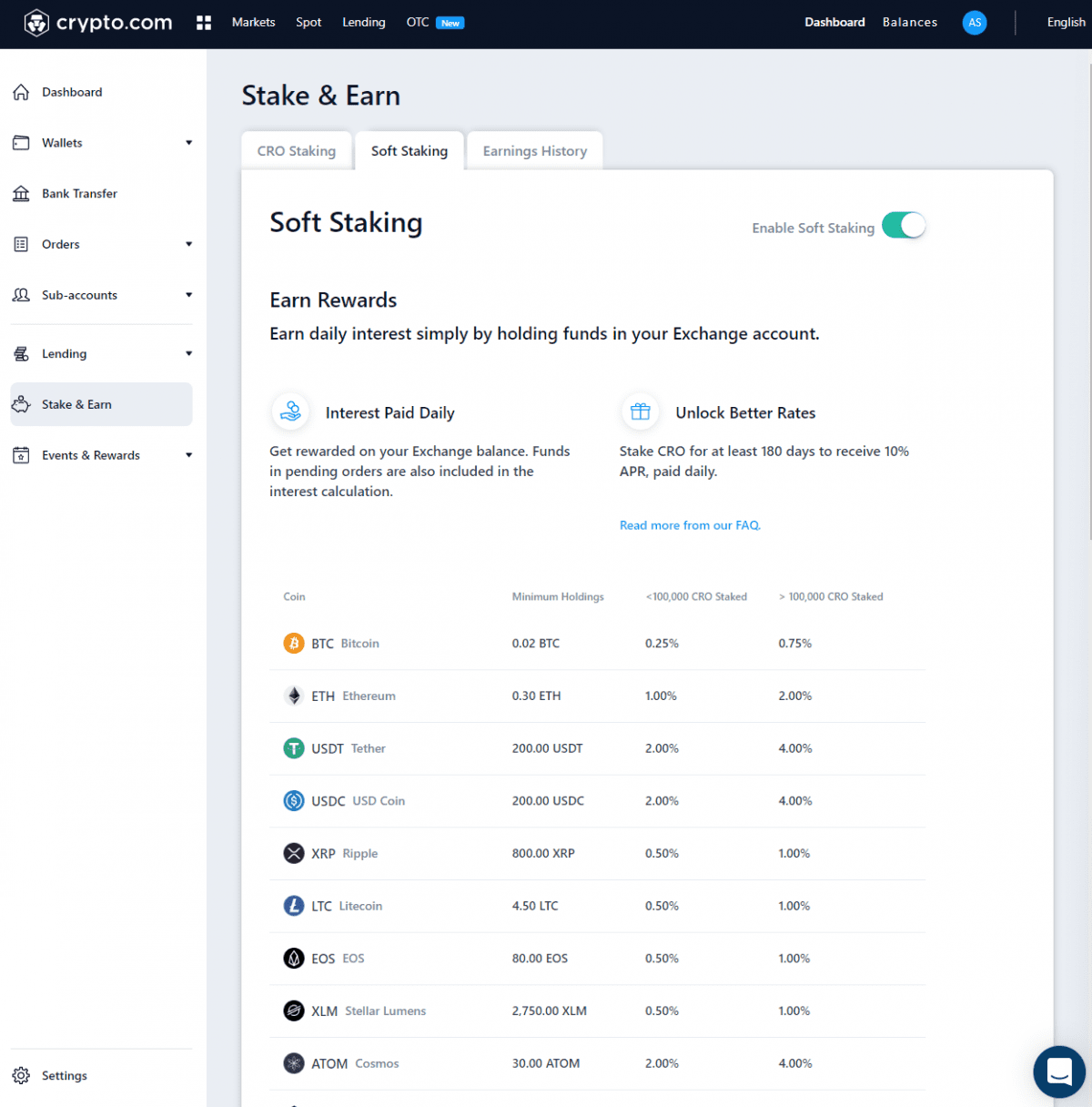

To access the Stake & Earn feature, you will need to create and verify an account with the Crypto.com Exchange which is separate from the Crypto.com mobile app. Once created, the soft staking module can easily be found on your dashboard.

Transferring any of the crypto into a staking wallet is not required. The interest rewards are based on the volume of supported assets you hold on the exchange and are calculated daily. Unlike other staking platforms, the advantage is that you still have access to your assets to trade whilst they continue to passively grow your portfolio. As an added benefit, even the crypto that you have on pending market orders will contribute to the calculation of interest. These features position the Crypto.com Exchange soft staking module as one of the better options for active traders.

| Name | Crypto.com Exchange |

|---|---|

| Supported Crypto | 32 |

| Stablecoin APY % | Up to 4% APY |

| Non-Stablecoin APY % | Up to 4% APY |

| Interest Pay Out | Daily |

| Fees | None |

| Terms | None |

The Crypto.com soft staking feature supports an enviable range of 32 cryptocurrencies that can yield you up to 4% APY. A number of popular stablecoins for trading can be staked including Tether (USDT), USD Coin (USDC), and DAI. Bitcoin, Ethereum, Ripple, Litecoin and Stellar Lumens are examples of high market cap assets that will return yields of up to 4% APY.

As with many other Crypto.com features, staking the platform’s native token CRO will unlock higher interest rewards. Specifically, if CRO is staked for more than 180 days then an additional 10% APY will be received.

Other important things to know about Crypto.com’s soft staking is that no minimum amount is required to start earning rewards, and interest is paid to your wallet daily.

Crypto.com Exchange Staking Pros and Cons

Pros

- Assets staked are still accessible and can be traded.

- Interest is calculated on the volume of assets held on the exchange and pending market orders.

Cons

- Low interest % APY compared to other staking platforms.

- Investment into CRO and staking it is required to obtain the highest interest rewards.

3. Kraken

BEST FOR ETH 2.0 STAKING

Established in 2011, Kraken is one of the world’s longest-serving cryptocurrency exchanges. The exchange provides investors and traders in over 190 countries including Australia, with access to over 100 digital currencies and a professional crypto exchange designed for serious traders. However, you should not be discouraged as the crypto staking services offered by Kraken are beginner-friendly.

| Name | Kraken |

|---|---|

| Supported Crypto | 12 |

| Stablecoin APY % | Not applicable |

| Non-Stablecoin APY % | 5% – 23% |

| Interest Pay Out | Twice a week |

| Fees | Unspecified |

| Terms | No lock-in contracts |

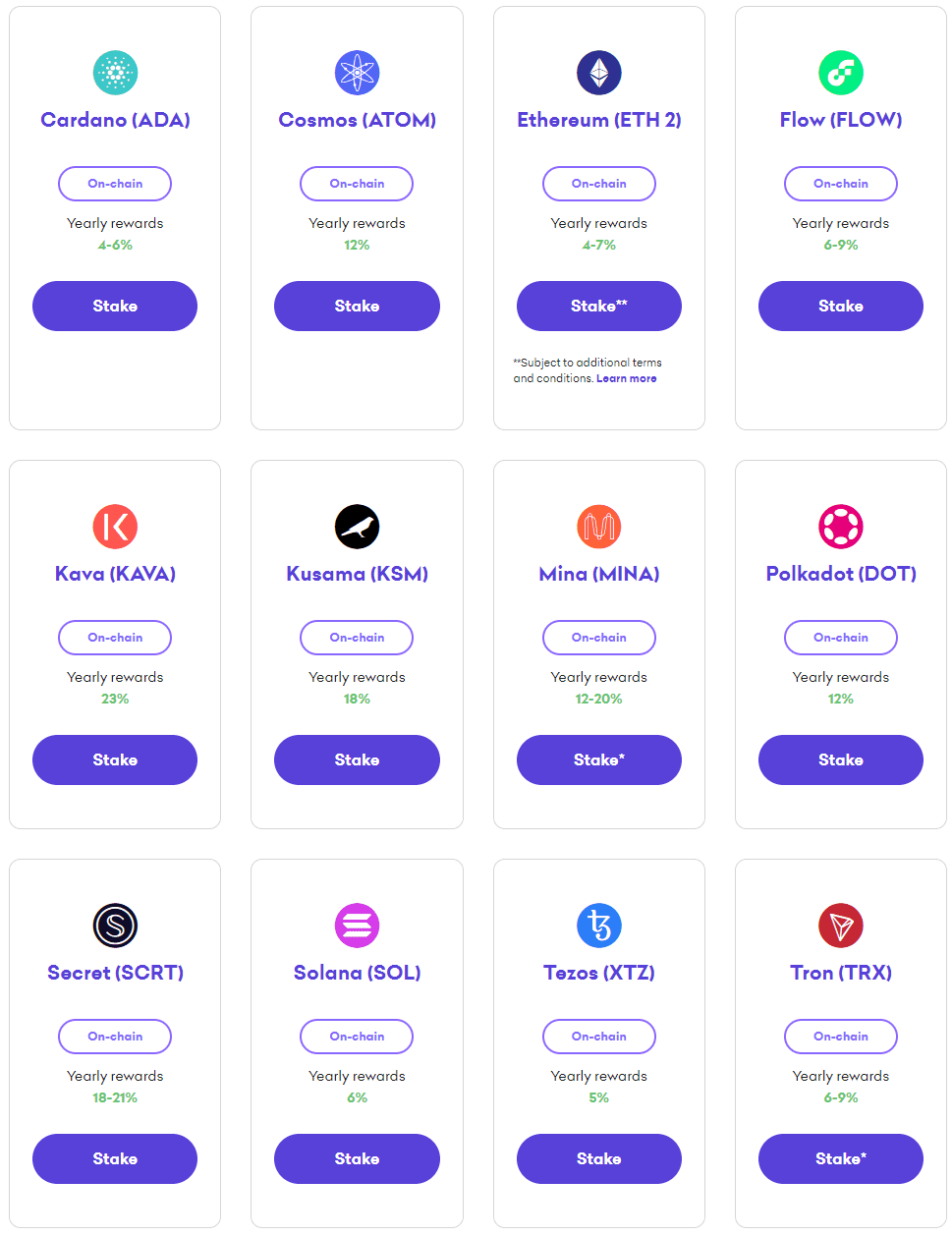

Kraken’s staking services are divided into On-chain and Off-chain staking. Whilst both offer similar features in the consumer sense (they both return interest yields to the customer), they differ because on-chain utilizes the Proof-of-Staking consensus protocol and off-chain does not. This is important because Australians are limited to on-chain staking assets.

Nevertheless, you can still stake 12 cryptocurrencies with interest yields ranging from 5% to 23% which are quite respectable returns in the Australian market. As shown below, you can stake digital assets such as Solana, Cardano, Tezos, Kava, Tron, and Ethereum 2.0.

The availability to purchase and stake ETH 2.0 along with its attractive yields between 4 – 7%, makes Kraken an ideal ETH 2.0 staking option. Once ETH 2.0 is staked, it cannot be removed until the Ethereum 2.0 upgrade is complete, so this would ideally suit long-term investors.

Other things you should about staking on Kraken include the lack of lock-in periods and payouts that are made to your wallet twice a week. Kraken is one of the few exchanges that provide you with a great deal of flexibility as you can withdraw your staked assets at any time, allowing you to use them for other purposes.

Kraken Staking Pros and Cons

Pros

- Trusted and reliable global cryptocurrency exchange.

- 4 – 7% APY yields on ETH 2.0 staking.

- Receive staking rewards twice a week.

- No lock-in contracts. Assets can be withdrawn at any time.

Cons

- Kraken does not specify their staking fees.

- Limited supported crypto to stake compared to other platforms.

- Staking stablecoins is not supported.

4. eToro Australia

AN ALTERNATIVE OPTION

eToro is a global multi-asset platform that is well-known for its social trading features and community. Since its inception in 2007, eToro has expanded across the world including Australia where investors can follow and copy the cryptocurrency trading strategies of successful users. The ASIC licensed and AUSTRAC registered platform also offers limited staking abilities for a range of digital assets.

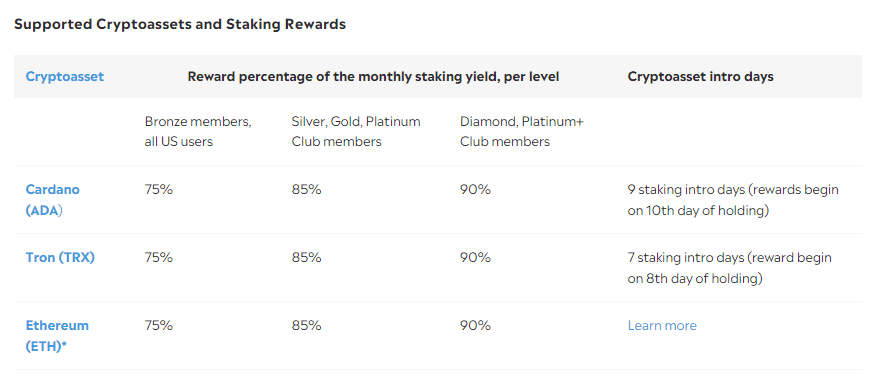

At the time of writing, eToro Australia provides staking features for 3 digital assets comprising Cardano, Tron, and Ethereum 2.0. The limited number of crypto that can be staked will not be appealing to most investors. This is also because the rewards from staking are dependent on your member level. For example, Bronze members will attract 75% of the maximum yields whilst Diamond, Platinum+ and Club members are the biggest beneficiaries where they will be rewarded with 90% of the maximum yield.

| Name | eToro Australia |

|---|---|

| Supported Crypto | ADA, TRN, ETH 2.0 only |

| Stablecoin % APY | Not available |

| Non-Stablecoin % APY | Not specified |

| Interest Pay Out | Monthly |

| Fees | Capped at 75%, 85% and 90% yields |

| Terms | Min. of 9 days for ADA, 7 days for TRN |

Whilst no set staking fees apply, eToro will retain a percentage of the maximum yields to cover their internal costs. With increasing levels of subscription membership, the lower the ‘fees’.

Staking rewards are calculated on the average daily amount over a monthly period, with yields paid into your wallet once a month. This is a far cry from the other staking options on this list where staking yields are seen in your wallet at least daily. If you’re an existing eToro user then you can expect to see an email explaining the staking rewards you received for that month, and how it was calculated.

Additionally, and unlike the other platforms on this list, ADA and TRN must be staked for periods of at least 9 and 7 days, respectively, before rewards start generating.

Overall, eToro’s staking features are limited, less robust, and not as lucrative compared to other alternatives on the Australian market. If you’re seeking a staking platform then eToro should be avoided. However, if you’re an existing eToro customer then there may be some benefit in utilizing its staking services.

eTorro Staking Pros and Cons

Pros

- A viable option for existing eToro customers to stake ADA, TRN, and ETH 2.0.

- Easy to understand interface that is ideal for beginners.

Cons

- Monthly payouts, capped yields, and a very limited list of supported assets.

- A waiting period for ADA and TRN applies before rewards start generating.

- Unable to purchase crypto with AUD and currency conversion fees for USD will be incurred.

eToro Australia Pros

- A viable option for existing eToro customers to stake ADA, TRN, and ETH 2.0.

- Easy to understand interface that is ideal for beginners.

eToro Australia Cons

- Monthly payouts, capped yields, and a very limited list of supported assets.

- A waiting period for ADA and TRN applies before rewards start generating.

- Unable to purchase crypto with AUD and currency conversion fees for USD will be incurred.

What Does Staking Crypto Do?

Staking is the process where cryptocurrencies are used to further develop a blockchain network by contributing to its governance and by validating and confirming transactions. Staking is only possible with cryptocurrencies such as Cardano and Solana that support the Proof-of-Staking (PoS) consensus model for processing transactions on the network. In return for committing your crypto, you will be rewarded with interest payments made out in the asset that was staked.

Is It Worth Staking My Crypto?

Staking your crypto has a similar effect to earning interest, however, the mechanisms are different. Nevertheless, the primary goal of staking for most investors is to earn interest on their assets and therefore generate a passive stream of additional income. Generally, interest rates can be as high as 70% depending on the coin staked. Staking PoS digital currencies is a great way for investors to utilize idle assets in their portfolios.

What Is A Crypto Staking Pool?

A staking pool is a tool that is hosted on the blockchain network for an asset that supports the Proof-of-Staking consensus protocol. Participants in the staking pool can pool their tokens and grant validating capabilities to the pool operator. This means that staking payouts can be sent to all pool members as rewards for contributing their coins for validating network transactions.

Pros & Cons Of Crypto Staking

Pros

- An easy method for generating a passive income on idle crypto assets.

- You retain full ownership and control on your assets.

- Most crypto exchanges offer streamlined staking services that are suited for entry-level investors.

Cons

- Some staking pools may be full and not available.

- Interest rewards from staking pools are not guaranteed.

Frequently Asked Questions

Can I Stake Crypto In Australia?

Yes, you can stake cryptocurrencies in Australia as long as they support the Proof-of-Stake (PoS) consensus protocol. Ethereum 2.0 (ETH), Cardano (ADA), Solana (SOL), and Litecoin (LTC) are popular digital currencies that can be staked on Australian platforms. Binance Australia is a commonly used staking option for its vast list of supported assets and attractive interest payouts.

Are Staking Rewards Different To Interest Payments?

Staking and interest-earning accounts are similar in that you receive crypto rewards over time, however, the mechanisms behind the rewards are inherently different. The interest gained from interest-earning accounts is offered by exchanges as incentives to hold your crypto with that exchange. Interest is usually consistent and paid at the same time every month.

The crypto rewards from staking are payments from the blockchain network for assisting to grow and develop the network. These payments are not usually guaranteed depending on the staking pool.

Did You Find What You Were Looking For?

Swyftx vs Crypto.com 2023: Which Is Better For Aussies?

Updated 02 Feb, 2023

There are quite a lot of differences in the crypto service offerings of Swyftx and Crypto.com. Which platform best suits your individual crypto needs?

Best Places To Earn Crypto Interest In Australia

Updated 02 Feb, 2023

There aren't too many options for Aussie to earn interest on their crypto, however, there is one local exchange that provides great rates on popular assets.

Digital Surge Referral Code – Claim Your Free $10 BTC

Updated 02 Feb, 2023

Our Digital Surge referral link will net you $10 free of Bitcoin upon creating a new account. Click here now to avoid missing out.