eToro Review 2023: Everything You Need To Know

Published 01 Oct, 2021 Updated 02 Feb, 2023

Table of Contents

- 1 Our Takeaways

- 2 What Is eToro?

- 3 eToro Pros & Cons

- 4 Top eToro Features You Should Know

- 5 Is eToro Safe To Use In Australia?

- 6 How Do The Fees Compare?

- 7 Accepted Countries

- 8 Getting Started

- 9 Trading Interface & Charting Tools

- 10 Customer Support & Reviews

- 11 Mobile App

- 12 eToro Alternatives

- 13 Frequently Asked Questions

- 14 Our Verdict

eToro is a global cryptocurrency exchange that is widely known for its social, stocks, and Contract For Difference (CFD) trading. Unlike some of the best crypto exchanges, you can connect with like-minded traders in the community and automatically copy-trade successful traders and portfolios through eToro’s unique social trading platform.

Promotion: None available at this time

Trading Fees: 1%

Available Cryptos: 25

We work with partners that may result in MoreCrypto earning a small commission. Read our affiliate disclaimer for further information.

Our Takeaways

| Name | eToro |

| Core Services | Fiat-to-crypto, copy trading, social trading |

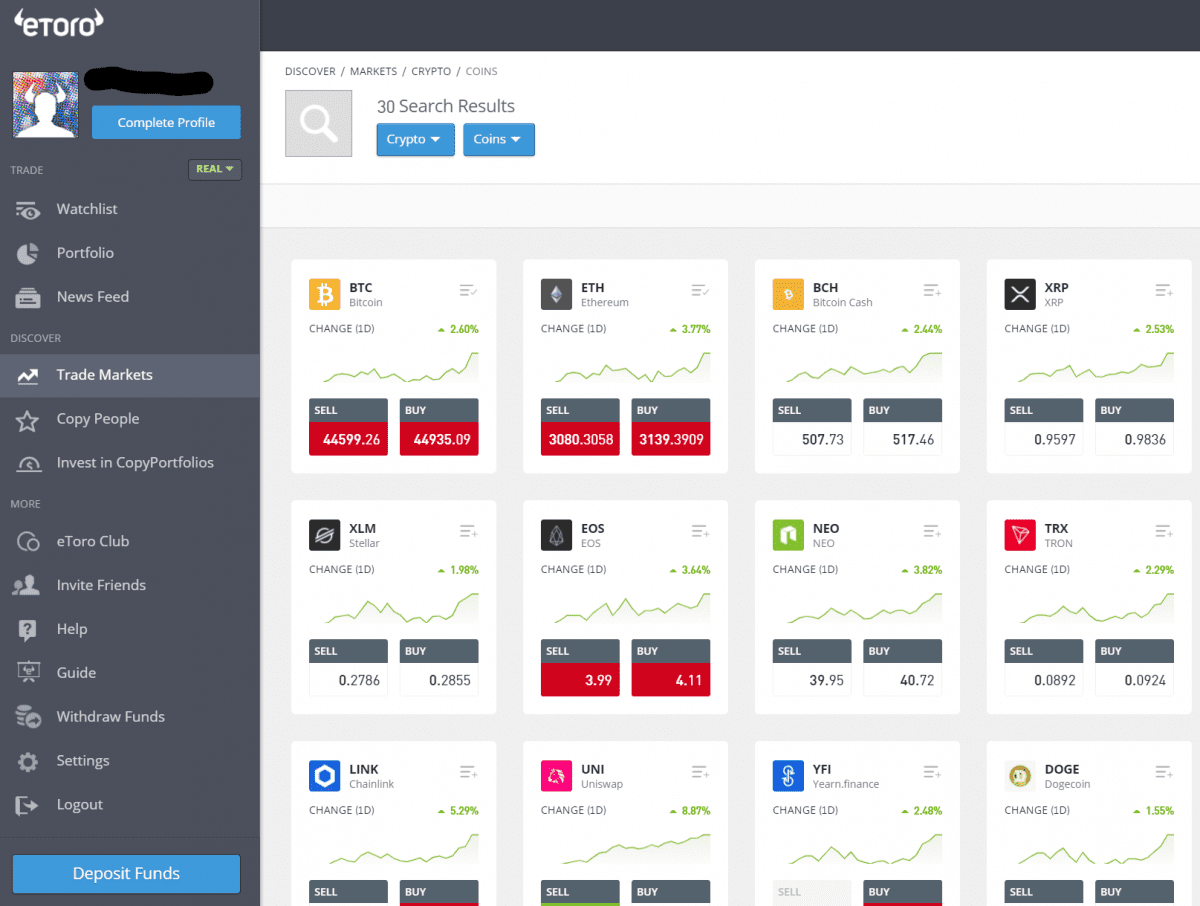

| Available Cryptocurrencies | BTC, ETH, BCH, XRP, DASH LTC, ETC, ADA, MIOTA, XLM and 15+ more |

| Deposit Options | Direct bank transfer, credit / debit card, Neteller, PayPal, Skrill |

| Deposit Fees | None |

| Trading Fees | 1% |

| Withdrawal Fees | USD $5 (excluding conversion fee to other currencies) |

| Mobile App | Yes |

What Is eToro?

eToro is a multi-asset social trading platform that offers cryptocurrency, stock, and CFD trading to people all over the world. Since its inception in 2007, eToro has expanded across the world and has reached over 20 million users. eToro is now a global leader in the social trading market.

Australian investors and traders can use eToro. The platform is a holder of an Australian Financial Services Licence issued by the Australian Securities & Investments Commission (ASIC). The primary fiat currency is the USD meaning that if you reside in a country outside of the US then you will need to pay currency conversion fees.

eToro Pros & Cons

Pros

- Beginner-friendly platform

- Demo account

- No trading fees (spread only)

- Available worldwide and accepts multiple fiat currencies

- Offers crypto, stocks, commodities and indices

- Unique social trading where successful portfolios can be copied

Cons

- High currency conversion fees

- High spreads for some crypto

- Limited selection of cryptocurrencies

- Not considered suited for advanced / technical traders

Top eToro Features You Should Know

Copy Trading

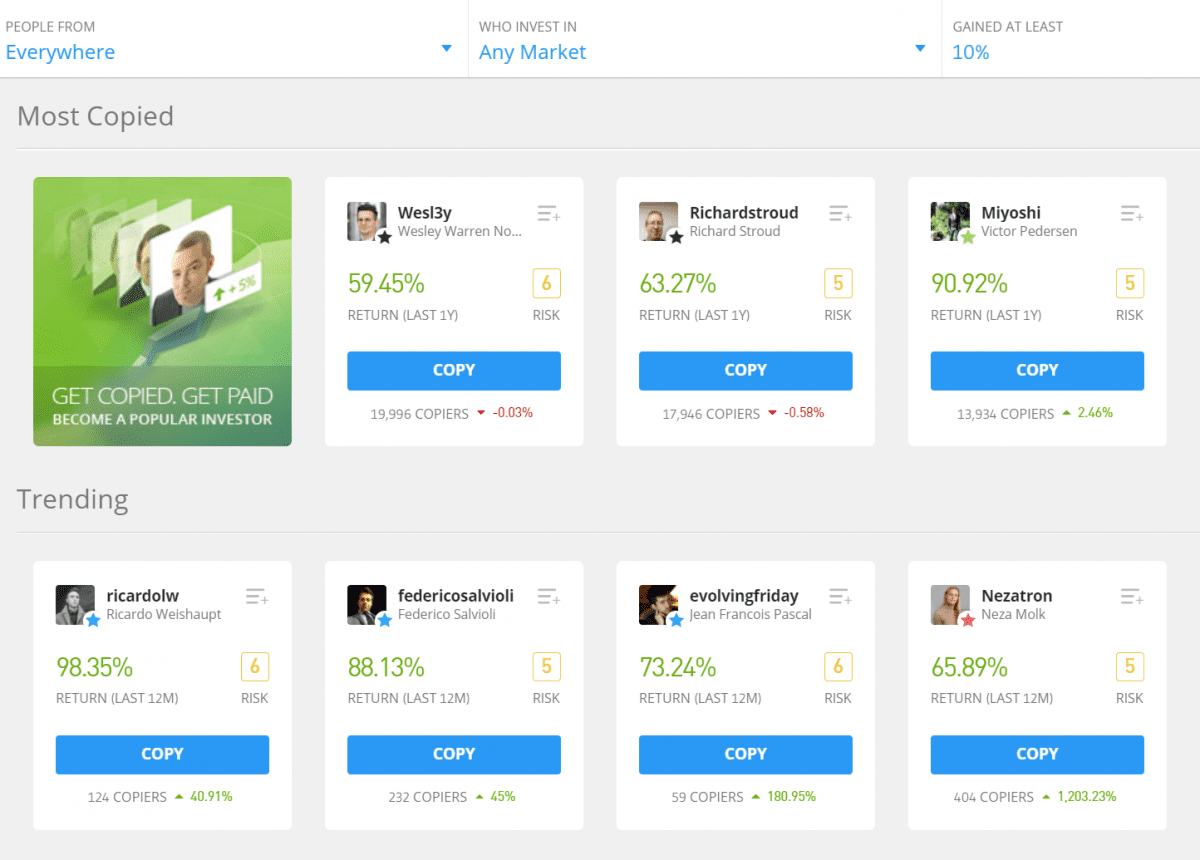

eToro’s copy trading feature is one of their most unique and compelling selling points. This form of social trading is not offered by most exchanges available to Australians and is a unique market differentiator for beginner investors who want to mirror the performance of successful traders. While most investors are accustomed to deciding which investments they want to get exposure to on their own, eToro provides two options which are “Copy People”, or Invest in a “Copy Portfolio”.

The Copy People function allows you to view the portfolios held by top-performing traders. You can sort through portfolios using the filters provided to view portfolios that may be appetizing to your investment objectives and needs. Portfolios are organized into the following categories:

- Editor’s choice

- Most copied

- Trending

- Long-term stock investors

- Long-short investors

- Multi-strategy investors

eToro also presents an indicative risk rating, however, you should conduct your research to minimize potential risk to your capital.

The “Copy Portfolio” feature is a portfolio management product that is quite similar to investing in a specific index where someone chooses a mix of assets to invest in for you.

By choosing a suggested portfolio, you will automatically obtain a copy of multiple markets or traders based on a predetermined investment strategy of their choosing. This is an incredibly easy way to build a diverse portfolio without knowing much about the specific investments, helping beginner investors to minimize their risk and obtain a top-performing portfolio.

There are two types of Copy Portfolios:

- Market Portfolios – Top performing assets from a specific market (e.g. crypto, semiconductor stocks, and technological companies).

- Top Trader – A collection of portfolios from top-performing eToro traders.

- Partner Portfolios – Investment portfolios developed by eToro and based on thorough market research and strategy.

Beginner Friendly Interface

The original trading platform was designed for beginners in mind. Although eToro has expanded its services, it has managed to maintain the same level of user-friendliness. eToro’s dashboard and trading interface are clean and well laid out, making it very easy to navigate and buy crypto.

eToro strives to make online trading and investments of a wide range of assets (including cryptocurrencies) very accessible to beginners and everyday users, and they have provided several resources to help newcomers get the hang of investing. A virtual tour of the platform is offered upon the first login so beginners can get the lay of the land.

While eToro’s method for buying crypto is straightforward, they also offer a fairly sophisticated trading interface that has been displayed in a way that is less overwhelming than other trading displays.

Demo Trading Account

Building further on their mission to make investing accessible to beginners, eToro provides an extremely useful demo or ‘virtual’ account where new users can begin with a $100,000 deposit to become familiar with the platform’s features and user interface. The demo mode has the same appearance as a real account and you can easily switch between the real and demo modes.

For those wanting to test the platform before putting any real money down, the demo version is perfect for allowing you to simulate real trades with no risk. Many new investors make several mistakes when starting, so eToro’s demo version makes the investing journey for those who are new to crypto a whole lot less daunting.

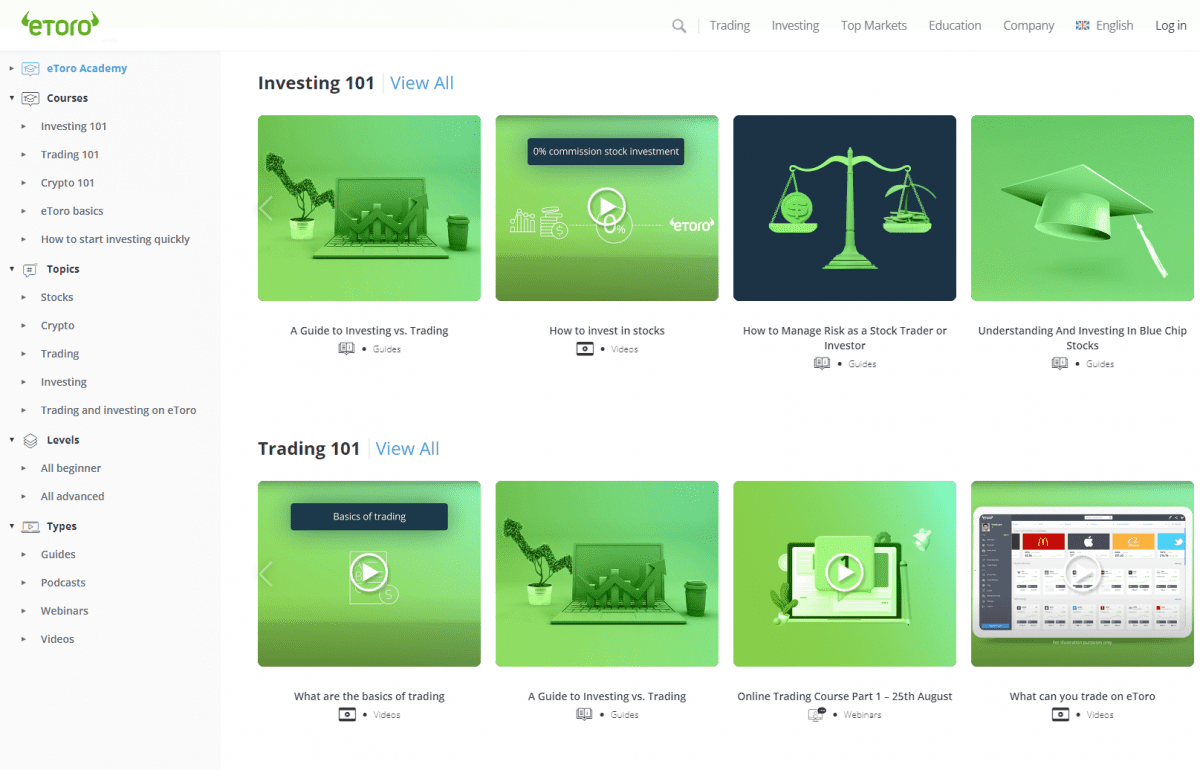

Trading Academy

eToro shows its commitment to helping newcomers learn the ropes of crypto investment by providing an impressive wealth of educational resources in their Trading Academy. Along with covering several investment topics including stocks, trading, and the basics of using the platform, their crypto education section is well built out and very accessible. While they have yet to build out their videos section for cryptocurrency, they do offer several helpful and interesting podcasts on cryptocurrency to help you stay up to date.

Is eToro Safe To Use In Australia?

In Australia, eToro is a secure and trustworthy social trading and cryptocurrency platform that is regulated by the Australian Securities and Investments Commission (ASIC). eToro is authorized by ASIC to provide financial services under Australian Financial Services License 491139.

Etoro implements best-in-class security measures to safeguard against the loss, damage, or theft of stocks and assets including bank-level encryption and firewalls. You have the option of activating 2FA on your account to provide another verification mechanism.

While some eToro-held assets are covered with insurance cover of up to $1 million, cryptocurrencies are not included under this insurance policy.

How Do The Fees Compare?

Deposit Fees

eToro charges zero fees for fiat deposits into the user wallet. However, several fees apply for cryptocurrency transfers. Specific crypto deposit fee details can be read here.

Trading Fees & Spreads

eToro charges a 1% fee for all crypto buying and selling orders and is included in the quoted price when you open or close a position. Whilst the spread is the difference between the buy and sell price of a digital asset, eToro offers set percentage spreads that differ depending on the asset purchased. Spreads begin from 0.75% for Bitcoin.

| CRYPTO ASSET | SPREAD |

|---|---|

| BTC | 0.75% |

| ETH | 1.9% |

| BCH | 1.9% |

| XRP | 2.45% |

| DASH | 2.9% |

| LTC | 1.9% |

| ETC | 1.9% |

| ADA | 2.9% |

| MIOTA | 4.5% |

| XLM | 2.45% |

Given that the trading volume for Bitcoin is the largest, the corresponding spread is the lowest. Altcoins with lesser trading volume typically attract higher spreads. Normally, the spread is ‘hidden’ amongst the transaction cost, so presenting set percentage fees provides a level of transparency to traders.

The 0.75% spread for trading Bitcoin is slightly higher compared to other Australian exchanges such as Digital Surge and Cointree which offer trading fees starting from 0.5%. Conversely, the spread fees for altcoins such as Cardano (2.90%) and MIOTA (4.50%) are significantly higher and you may want to consider a cheaper alternative if trading these coins is likely to occur.

Withdrawal Fees

Regardless of the amount, every withdrawal from eToro will attract a withdrawal fee of USD $5. Since all withdrawals (and deposits) are conducted with USD, Australians will also incur a currency conversion fee. Based on our reviews, Australians have access to several other exchanges where zero withdrawal fees are charged. The fee structure of eToro should be assessed by traders and investors before committing.

Accepted Countries

eToro is available in Australia for individuals to use however investors are not able to purchase actual crypto as it is not registered with AUSTRAC. Instead, the platform is a regulated CFD provider that complies with local laws that are enforced by ASIC.

The platform does not have a license to sell actual cryptocurrency assets. Users that want to directly purchase Bitcoin and other digital assets will need to use an AUSTRAC regulated exchange such as Swyftx, Digital Surge, or CoinSpot.

Getting Started

Account Creation & Verification

You will need to provide a username, email address, and password to create an eToro account. eToro verification is mandatory if you want to trade on the platform. The process and information to be submitted vary slightly across each jurisdiction in accordance with local regulations. It usually takes a few days for eToro to complete the identity verification procedure.

Deposit Methods & Limits

eToro operates using USD which means that investors from Australia or other countries will need to pay a currency conversion fee (when a deposit and withdrawal occur). Supported fiat currencies that will incur a conversion fee include EUR, GBP, AUD, RMB, THB, IDR, MYR, VND, and PHP. Currency conversions are carried out at the prevailing spot rate with a typical mark-up of 50 Percentage Points (PIPs).

Depositing funds into a new account can be undertaken using a credit/debit card, POLi, PayPal, Neteller, Skrill, and direct bank transfer. Australians should note that deposits can only be made using credit/debit cards, POLi and PayPal.

| DEPOSIT METHOD | FIAT | SPEED | MAX. LIMIT |

|---|---|---|---|

| Credit / debit card | AUD, USD, EUR, BGP | Instant | $40,000 |

| PayPal | AUD, USD, EUR, BGP | Instant | $10,000 |

| POLi | AUD, USD, EUR, BGP | Instant | $70,000 |

| Bank transfer | USD, EUR, BGP | 3 – 7 days | $10,000 |

| Neteller | USD, EUR, BGP | Instant | $10,000 |

| Skrill | USD, EUR, BGP | Instant | No limit |

Trading Interface & Charting Tools

eToro uses professional charts to offer a clean and uncluttered charting interface that will be useful to both beginners and experienced traders. While the platform offers a number of risk management tools, including stop-loss orders, they have intentionally stripped back the visual display of the trading interface in order to give a less overwhelming view of an assets price chart.

eToro provides a range of options and tools for asset analysis suitable for beginners, but experienced traders who want more comprehensive charting capabilities and technical indicators should consider platforms that utilize TradingView. This package is generally regarded as the premium charting interface in the crypto world.

Customer Support & Reviews

If you need support then you can access the “Help” tab on the user interface where numerous Frequently Asked Questions (FAQs) are located. If a query is not able to be answered then you can reach customer support via submission of a ticket.

We submitted a ticket with a query relating to fees and the insurance policy and our experience with the support team was generally positive. Whilst the waiting period was three hours, the response was direct and specifically addressed the query. The live chat is only available for club members during business hours. This is an area for improvement to make instant assistance more accessible for beginners.

Based on 8,600 TrustPilot reviews, eToro has received a rating of 3.6 / 5.0. Nearly 40% of customer feedback on eToro’s easy-to-use interface, online experience, and great customer support has been rated as excellent. However, almost 40% of customer feedback was rated as negative and mostly related to account managers, varying customer service, and technical issues on the platform. Overall, the highly polarised feedback does not reflect well on the eToro customer support team.

Mobile App

eToro offers a mobile app that is compatible with iOS and Android devices. The mobile app allows eToro users to view real-time market price alerts, investment reports, a summary of their trades, and asset market values.

eToro Alternatives

eToro is a world leader in the cryptocurrency social trading space. The following crypto exchanges offer similar, if not better, products and services compared to eToro.

- Swyftx (best overall Australian exchange). Swyftx is our best-rated cryptocurrency exchange that is available for Australian investors and traders. The platform has a wide variety of features including a well-designed user interface, deep liquidity, low spreads, DCA, and advanced trading tools. The platform also supports more than 270 digital assets which are significantly more than ZebPay.

- Digital Surge (best exchange for beginners). Digital Surge is a beginner-friendly platform with low trading fees (0.5%), more digital assets are supported (270+), and it provides a few innovative features including in-built tax tools and the ability to pay Australian bills with Bitcoin. Digital Surge supports Australian investors.

- CoinSpot (most trusted exchange). Coinspot has been offering a highly secure platform for Australian investors to buy and trade crypto for a long period of time. This has resulted in Coinspot earning the reputation of Australia’s most trusted cryptocurrency exchange.

- Plus500 – is a leading provider of Contracts for Difference (CFDs) which allows advanced traders to speculate on cryptocurrencies, shares, Forex (FX), commodities, ETFs, options, and indices. Plus500 is widely known for its top-class mobile app. Leverage of up to 30x is available on popular assets including Bitcoin, Ethereum, and Litecoin. Only suitable for experienced and advanced traders.

- Gate.io – Gate.io is a serious crypto platform that offers spot and derivatives trading. Similar to eToro, the platform also offers Copy Trading where you can view and copy the trading strategies of successful traders.

Frequently Asked Questions

Is eToro Regulated?

In Australia, eToro is a holder of Australian Financial Services Licenced issued by ASIC. The platform is a licensed and registered financial company in multiple trading jurisdictions around the world including Europe under the Cyprus Securities & Exchange Commission, and in the UK by the Financial Conduct Authority (FCA).

Can Australians Use eToro?

Traders and investors based in Australia are available to use eToro. The platform is a regulated CFD provider that complies with local laws that are enforced by ASIC. eToro trades under the company eToro AUS Capital Pty Ltd, AFSL 491139, and holds an Australian Financial Services License (AFSL).

However, the platform does not have a license to sell actual cryptocurrency assets in Australia. If you want to directly purchase Bitcoin and other digital assets, you will need to use an exchange that is regulated by AUSTRAC.

Our Verdict

Overall, eToro is an incredibly fluid and enjoyable platform that is aptly suited for beginner traders. It is a global leader in the social trading space with beginners able to copy successful portfolios, practice trading on a demo account, and have access to comprehensive education content.

That being said, eToro operates in USD and Australians will need to consider the extra currency conversion fees. Other drawbacks include the relatively high fees, limited selection of supported crypto, and the basic charting tools.

Did You Find What You Were Looking For?

Swyftx vs Crypto.com 2023: Which Is Better For Aussies?

Updated 02 Feb, 2023

There are quite a lot of differences in the crypto service offerings of Swyftx and Crypto.com. Which platform best suits your individual crypto needs?

Best Places To Earn Crypto Interest In Australia

Updated 02 Feb, 2023

There aren't too many options for Aussie to earn interest on their crypto, however, there is one local exchange that provides great rates on popular assets.

Digital Surge Referral Code – Claim Your Free $10 BTC

Updated 02 Feb, 2023

Our Digital Surge referral link will net you $10 free of Bitcoin upon creating a new account. Click here now to avoid missing out.